Supply chain limited by Russia / US CHIPS Act a game changer

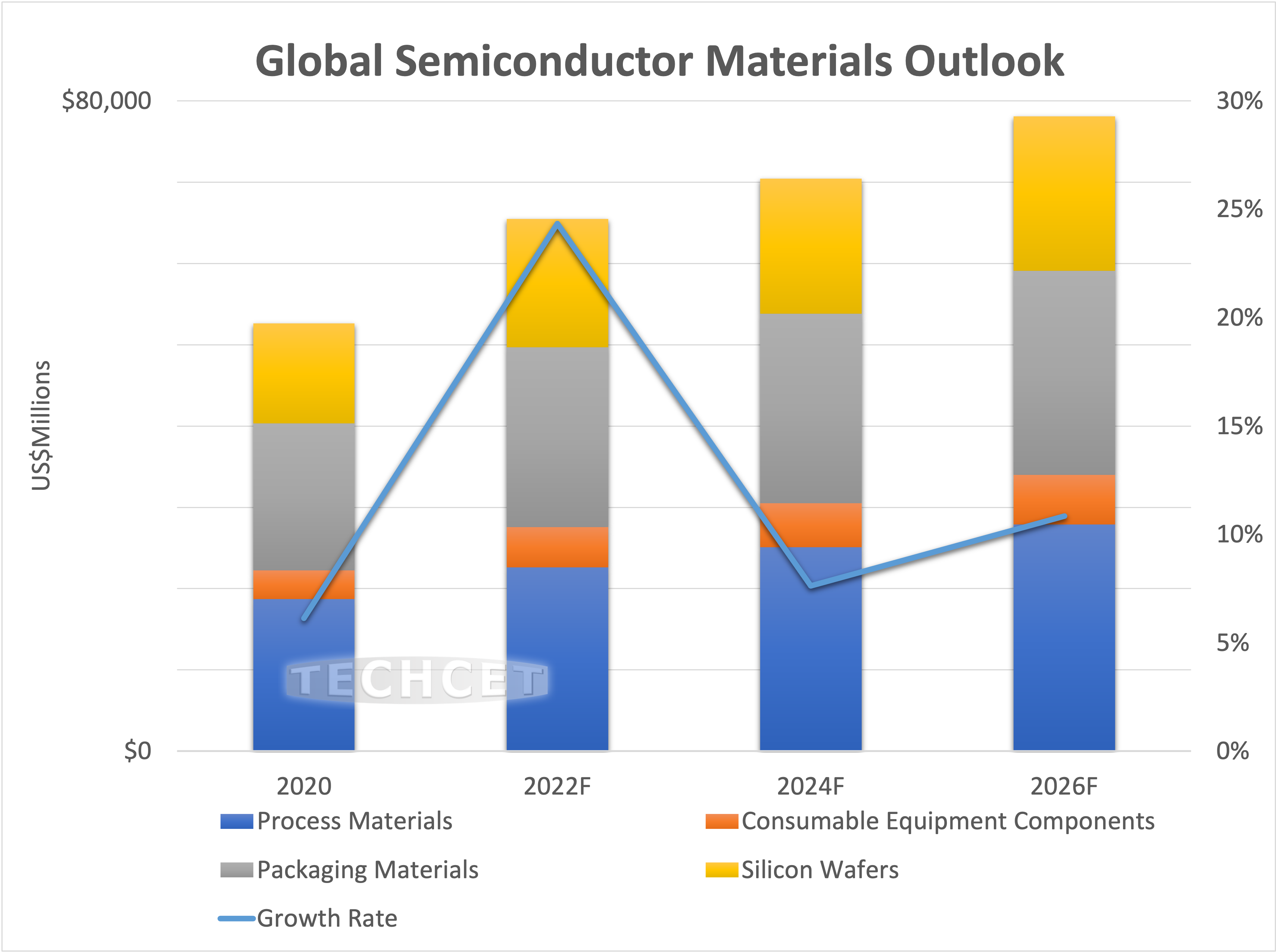

San Diego, CA, July 6, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— is forecasting semiconductor manufacturing materials to top US$65 B for 2022, a healthy 8% above 2021. “Semiconductor demand has remained strong through the first part of the year and average selling prices for materials are trending upwards,” cited Lita Shon-Roy, TECHCET’s President/CEO. In anticipation of slower market conditions, semiconductor materials market growth is currently forecasted to increase just over 2% in 2023 before further improving in 2024. “This is in keeping with cycles in demand and inventory volumes,” said Shon-Roy, as “per the latest TECHCET Critical Materials Reports™,” shown in the figure below.

While demand remains strong in 2022, a number of issues are impacting materials supply and pricing. The Russia/Ukraine region is a major part of the oil and natural gas supply chain, of which energy, specialty gases and helium are dependent. It was a region expected to play a significant role in the supply of helium this year, in addition to supporting neon and fluorocarbon production used for semiconductor manufacturing. Due to the turmoil in this area, alongside related economic sanctions against Russia, supply of these and other key gases have been curtailed, straining supply-chains around the world. Additionally, energy costs have steeply risen creating cost escalation of materials production worldwide.

In today’s business environment, surcharges for energy, logistics, and materials are increasing in costs across many materials segments. For silicon wafers, supply is limited as current production is constrained since no new green field production is available to ramp up for this year and into 2023. Hence, prices on wafers are rising.

For other material segments, from rare gases to sputtering targets, costs and prices are also rising due to price increases in raw materials, in addition to high energy and logistics prices. All of these are further exacerbated by supply-demand imbalances. Consequently, materials’ availability is becoming a limiting factor to semiconductor unit growth. (Note: upward trending ASPs will likely drive decent revenue growth for the year.)

Demand for semiconductors though the rest of the year, should remain strong. However, TECHCET sees the above trends contributing to inflation, and worries about another recession are now looking more likely. Whether this could result in a temporary dip in demand or prolonged recession impacting overall chip demand is not yet clear.

The game-changer for the US semiconductor market will be the CHIPS Act. Once fully approved by Congress, the CHIPS Act will buoy up the market allowing for further growth. However, the question remains, “Will there be set asides in the CHIPS Act for materials production and R&D?” This will be highly dependent on US policymakers and their interpretation of what is and is not needed to strengthen US’ position in semiconductor technology and manufacturing. Currently, a growing number of material companies are individually communicating to policymakers about the importance of CHIPS Act funding for US materials producers. The key to their message is that the cost of building a semiconductor gases and chemicals plant in the US is prohibitive. These materials are highly specialized and more costly to produce than industrial gases and chemicals. And the clincher is that the volume demands are 10X to >100X lower than industrial applications. Hence, the ROI on investing in a new US chemical production facility for semiconductor materials is so poor that many chemical companies will be unable to justify building it without subsidy. We hope through the continued efforts of individual material suppliers, TECHCET’s information on materials submitted to the US RFI, and SEMI’s work on the CHIPS Act, that the US Congress will indeed set aside monies in the CHIPS Act for building and expanding US materials production.

For more information, see TECHCET at SEMICON WEST, July 12-14, at the New York State Economic Development booth, 2051. Or go to TECHCET’s Critical Materials Reports™ and Market Briefings: https://techcet.com/product-category/critical-materials-reports/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.