2023 Semiconductor Plating for Device and Packaging Expecting Slowdown as Global Economic Conditions Weaken

New Technologies such as Ruthenium and Molybdenum in Barrier Layers May Also Replace Old Plating Standards

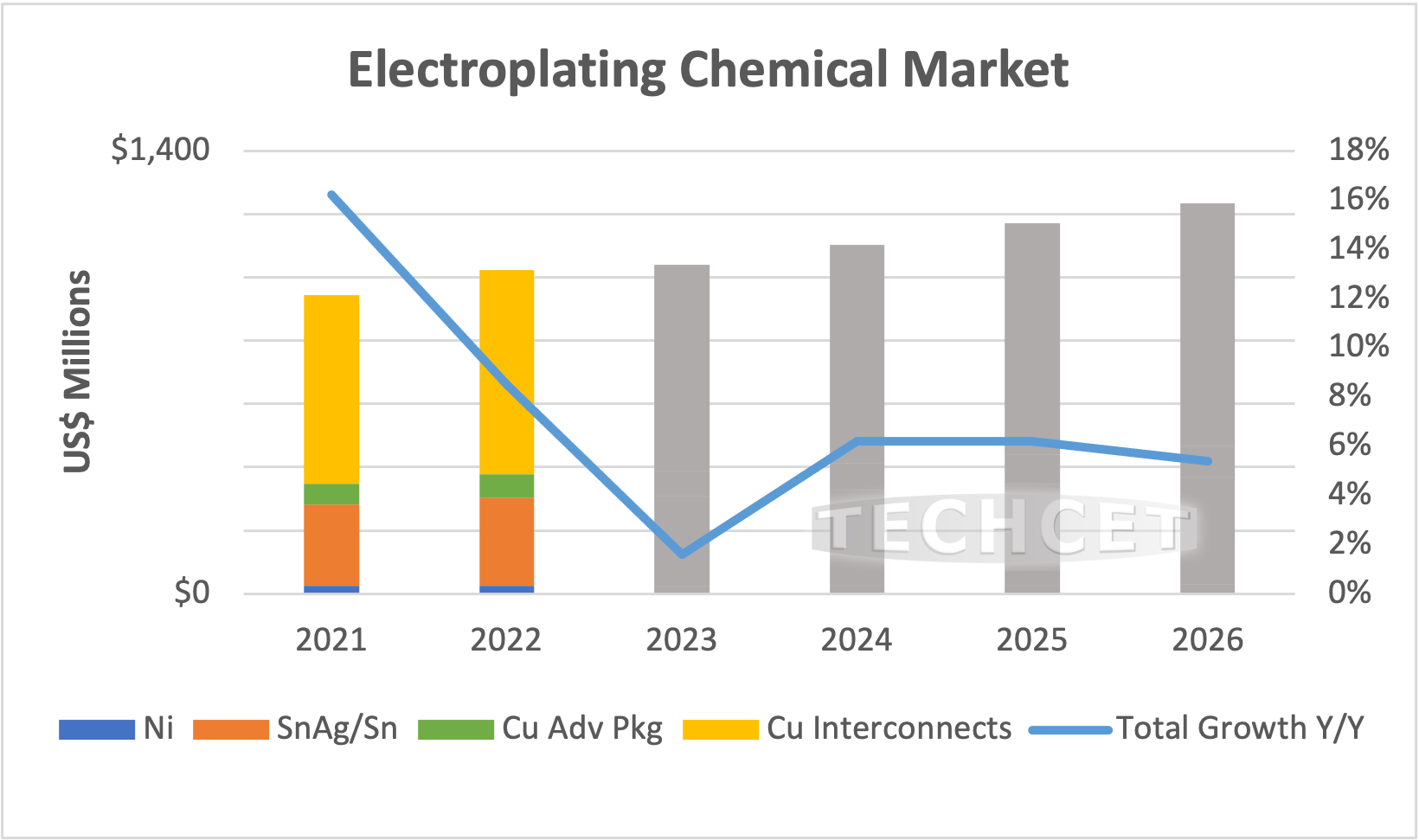

San Diego, CA, January 4, 2023: TECHCET—the advisory firm providing business and technology information on the semiconductor materials supply chain — announced that the revenue growth for the 2023 Semiconductor Plating Market is expected to rise only 2% above 2022. This is a significant decline compared to the 8.3% growth seen in the 2022 market from 2021. One main reason for this forecasted slowdown is the slower economic conditions that are expected to impact the 2023 semiconductor market, at least through the first half of the year. TECHCET now forecasts plating chemical revenues to grow to US$1.02B in 2022, and then to US$1.04B in 2023 (Source: TECHCET’s newly released CMR™ on Metal Plating).

Stronger growth rebounds are expected in 2024 as demand for more devices for numerous applications (electric cars, more fast charging stations, more data storage, etc.) are expected to produce higher density and lower power devices. In addition, the US Chips Act and similar investments by Europe and China are expected to contribute towards market growth. Both these factors will drive more metal interconnect layers and more advanced packaging.

TECHCET’s Sr. Director, Dan Tracy, states, “Advanced Packaging requirements continue to be driven by increases in Wafer Level Packaging (WLP), and by consumption in the high-performance devices that utilize Redistribution Layers (RDL), interposers and Through Silicon Via (TSV) technologies.” Heterogenous integration, EMIB, Chiplets, and the power devices are expected to challenge the plating requirements in terms of quality of material being deposited.

Logic Gate All-Around (GAA) transitions node is planning to use backside power rails which appear to add at least four metal interconnect layers to the backside of the wafers.

TECHCET is following the introduction of Ruthenium or Molybdenum to possibly displace the Tantalum and Cobalt barrier layer at the GAA nodes. Ruthenium or Molybdenum (ALD or CVD, not plating) will possibly fill the interconnects and vias between M0 to M3 metal layers for Advanced Logic. Possible wafer backside connections to the backside power rail will add Copper plating to possibly match lost the loss of Copper plating at the M0-M3 layers.

For more details on the semiconductor Electroplating Chemicals market, supply-chain and growth trajectory, including supplier profiles on BASF, Dupont, Chang Chun Group, Ishihara Chemical/Unicon, and more, go to: https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/.

ABOUT TECHCET: TECHCET CA LLC is an advisory research firm focused on analyzing the electronics materials supply chains for the global semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, supply chain analysis reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.