Will growth slow enough to meet PFAS environmental challenges?

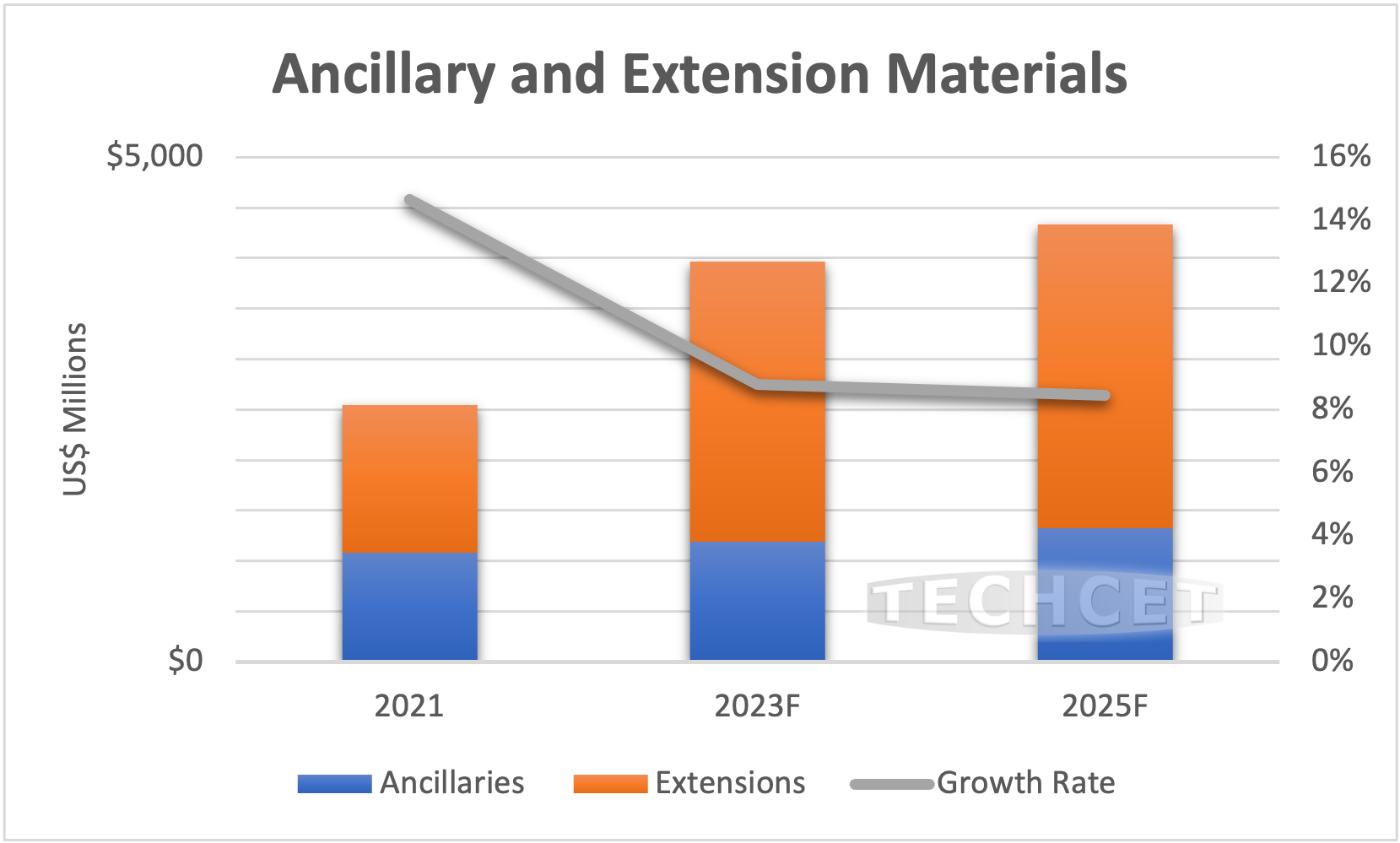

San Diego, CA, July 26, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— announced an updated outlook of the Lithography Extension and Ancillary Materials market segments. These advanced chemistries, which include developers, anti-reflective coatings, edge-bead removers, and others, are forecasted to grow by over 6% in 2022, and will approach a US$2.8 Billion market in 2023. As highlighted in TECHCET’s new Lithography Materials CMR™, total market revenues of the segment will grow by >5% CAGR through 2026 as EUV and KrF lithography applications continue to ramp in the semiconductor industry. However, growing environmental concerns related to PFAS (per-and polyfluoroalkyl substances) containing chemicals used in lithography materials may pose future production limitations.

The US$1.2 B Ancillary (organic developer, edge bead remover, and prewet) market segment is experiencing changes in material sets with the implementation of EUV lithography in high volume manufacturing. For example, organic developers are ramping as the developer of choice for Negative Tone EUV resists. As additional patterning levels migrate to EUV, this will reduce both 193i DUV photoresist and aqueous developer volume consumption at the critical layers; thus, aqueous developers should eventually see a decline as organic developer consumption grows.

The transition away from 193 nm immersion (multi-patterning) will drive other changes in the fab. For example, the Negative Tone resist can be processed without edge bead removal. Also, the implementation of a Dry Processed photoresist, if widely adopted, will not require a developer as a plasma removes the resist material.

Extension materials, which are specialty materials used to address reflections and adhesion problems during photoresist processing, make up a US$1.6 B market. This market is fragmented with a couple of companies that focus specifically on Bottom and Top side Antireflective Coatings (BARC/TARC), in addition to the photoresist suppliers providing both resists and ancillaries. Silicon based BARCs layer are consumed in high-resolution applications. Another fast-growing segment will be in KrF BARC as this application gets a boost from growing layer counts in 3D NAND Flash process fabrication.

Concerns relating to PFAS containing chemicals, which include some photoresists and ARCs, have been increasing over the past several years. Because of this, many chip companies are now pressing for alternatives in hopes of eliminating their use. Many of the large resist and ancillary companies have alternative offerings, although many end-users have not had the luxury of time to identify acceptable alternatives and make the switch. Recent announcements by the EPA highlight six PFAS materials included in the Regional Screening Level and Regional Removal Management Level lists (started in 2014 and updated it in May of 2022). These include: hexafluoropropylene oxide dimer acid and its ammonium salt (HFPO-DA – sometimes referred to as GenX chemicals), perfluorooctanesulfonic acid (PFOS), perfluorooctanoic acid (PFOA), perfluorononanoic acid (PFNA), perfluorohexanesulfonic acid (PFHxS), and , PFBS or perfluorobutanesulfonic acid. In particular, PFOS and PFOA are common materials found in ARCs and resist materials.

“For the suppliers of just Ancillary and Extension materials, and not photoresists, long-term relationships with customers and photoresist partners are key for finding acceptable alternatives in the midst of demand for higher resolution technology,” states Dan Tracy, senior analyst at TECHCET. As with photoresists, co-development work between supplier and chip company is required to complete the process of introducing alternative materials into existing production lines. A balance must be found between running production full-out to meet chip demand, and stopping the line to qualify for these environmentally-friendly alternatives.

For more details on the Electronics Litho Materials market information including suppliers Avantor, Dongjin, Fujifilm, JSR, Kempur, SEH, DuPont, and others go to: Litho Materials CMR-NEW | TECHCET

For more details on EPA Actions to Address PFAS use, go to: https://www.epa.gov/pfas/epa-actions-address-pfas

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.