San Diego, CA, October 17, 2019: TECHCET—the advisory services firm providing electronic materials information— announced that the 2019 global market is softening for structural ceramics components needed in semiconductor Original Equipment Manufacturer (OEM) tools. Reports of ~ 15% year-over-year (YoY) drop in OEM tool sales are somewhat balanced by ceramic components growth in parts of Asia being net positive in 2019, so overall world-wide ceramic components sales are forecasted to be US$1.37 billion in 2019, which is just -5% YoY. A slow recovery is expected in 2020 leading to a forecasted ~4% compound annual growth rate (CAGR) over 2018-2023.

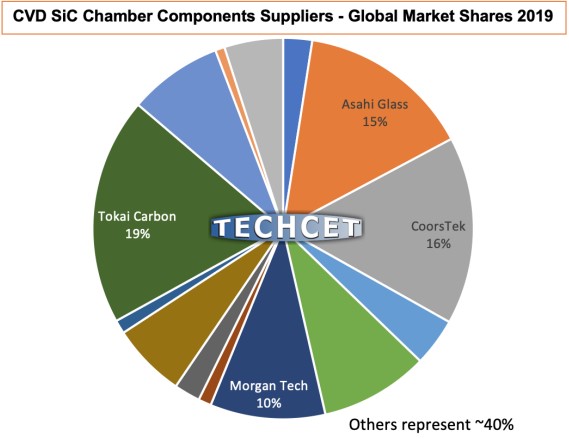

The highlights of the structural ceramics market include CVD silicon-carbide (SiC) and High Purity Alumina (HPA) parts. In particular, CVD SiC sales are supported by the trend of replacing quartz and alumina in the most advanced process chambers. CVD SiC is expected to grow >4% per year through 2023, and it is possible that >50% of SiC parts will be using CVD SiC in some form, including SiC:Graphite composites and CVDSiC on SiC components. Many components suppliers serve this market, although the top 3 companies in the lead remain Tokai Carbon, CoorsTek, and Asahi Glass (see Figure).

This report covers the following suppliers: ADMAP, Applied Ceramics, Asahi Glass, Bridgestone, Carborundum, Ceredyne/3M, CoorsTek Semiconductor Equipment Component, CoorsTek-Saint Gobain, CoorsTek, DuPont, Entergis, Ferrotec, Hitachi Chemical, Kyocera, Maruwa, Mersen, Morgan Technical Ceramics, NGK/NTK, SGL Group, Solmics, Toyo Tanso, Tokai Carbon Korea, Tokuyama, USTC, Worldex, Xycarb Ceramics, and more!

Purchase Reports Here: TECHCET Reports