Electronic Wet Chemicals Price Volatility Sparks Concern

Price volatility in chemicals used for semiconductors further strains market

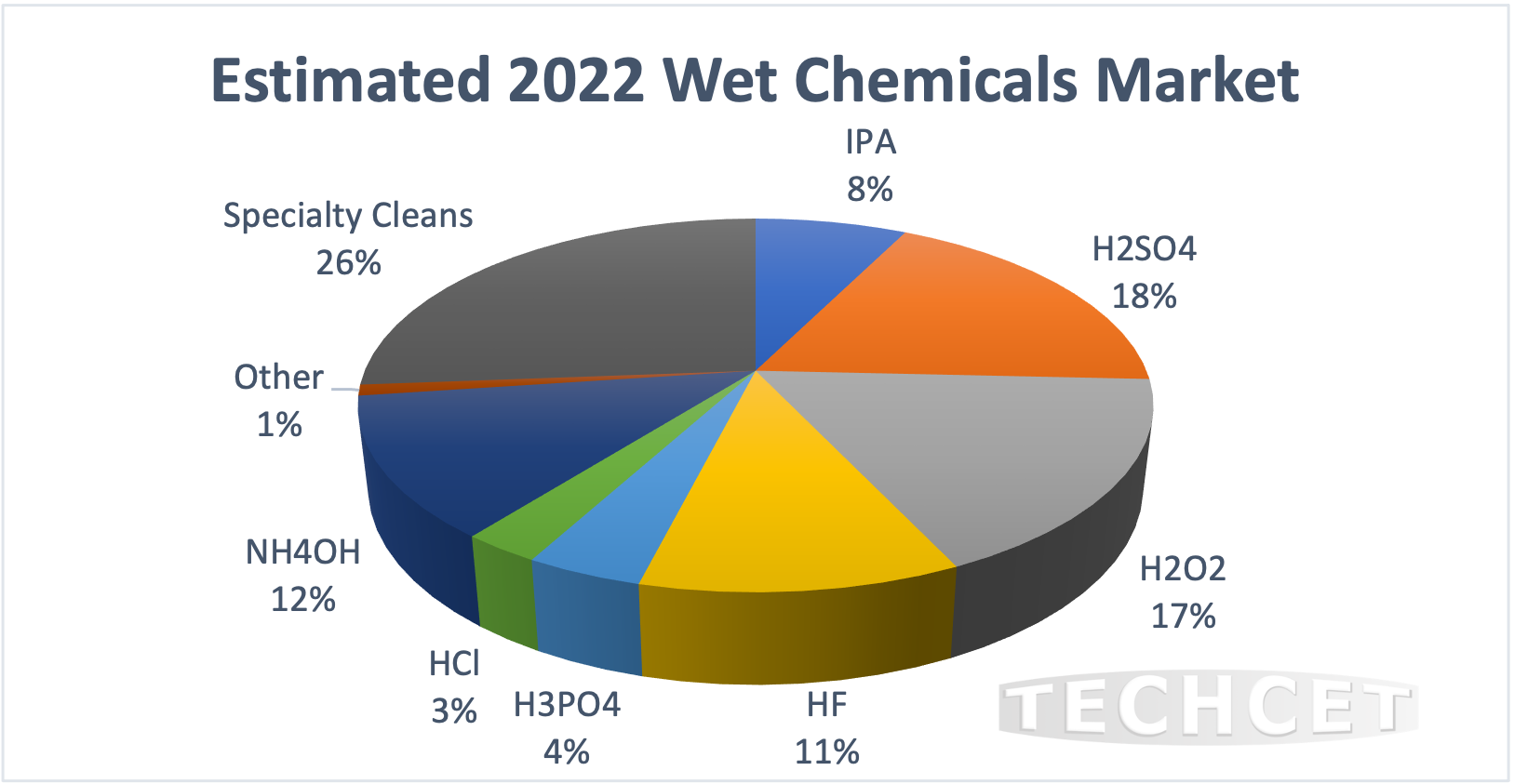

San Diego, CA, September 27, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— has witnessed a wide range of price volatility for multiple wet chemical and specialty cleans market segments. This in combination with the high demand across the semiconductor industry is causing concern among chip makers and suppliers alike. TECHCET’s current forecast shows a 6.7% revenue growth for the wet chemicals segment, expected to reach US 4.2 billion for 2022. However, forecasting has been a moving target as costs and prices have fluctuated unexpectedly, as highlighted in TECHCET’s latest 2022 Wet Chemicals Critical Materials Market Report™.

Isopropyl Alcohol (IPA) saw price decreases at the end of the second quarter in both North America and Europe due to decreasing costs of chemicals used in its manufacture. Acetone, a chemical used as a replacement process for generating IPA, initially had inflated prices due to rising crude oil pricing, but eventually dropped due to high inventories. Similarly, upstream propylene pricing impacted the price declines in the IPA market.

Other chemicals like Hydrochloric Acid (HCL) and Sulfuric Acid (H2SO4) faced price increases as a result of high demand and other supply chain events. For HCL, high demand from the steel industry and a high inflation rate due to other global events caused upward pressure on prices in the USA. Additionally, Olin, a primary chlor-alkali plan, faced a force majeure leading to crippled availability of inventories for HCl in North American region. In Europe, H2SO4 demand rose though crude oil prices rose and other raw materials experience price fluctuations.

“Price fluctuations are expected to continue until we come out of this uncertain period of rising inflation and energy costs,” stated Lita Shon-Roy, President / CEO of TECHCET. “In 2023, we expect to see a slowing of total electronic wet chemical revenues to 1.8% growth.” The slowdown will be the result of normal cycles of chip inventory corrections combined with uncertainties in the global economy. In the short term, inflation and rising costs of energy and raw materials adds to the threat of recession. This combined with on-going trade issues between the U.S. and China, alongside tensions in the Ukraine-Russia region can threaten the overall wet chemical industry growth. However, more than US$500 billion of investments have been announced for chip expansions to be built over the next 5 years. Approximately US$130 billion of this is planned just for the US. Given that many of these fabs are planned to begin production by mid-2024, another strong growth cycle is expected to start in 2024 and carry the industry into the next decade.

For more details on the Wet Chemicals market and growth trajectory, including supplier profiles on companies like Atotech, AUECC, Avantor, FujiFilm, Eastman, Chemtrade, Dupont, and more, go to: https://techcet.com/product/specialty-cleaning-chemicals/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.