Growing Supply Chain Risks for Germanium and Gallium

How can the US stabilize Ge/Ga supply to support high semiconductor demand?

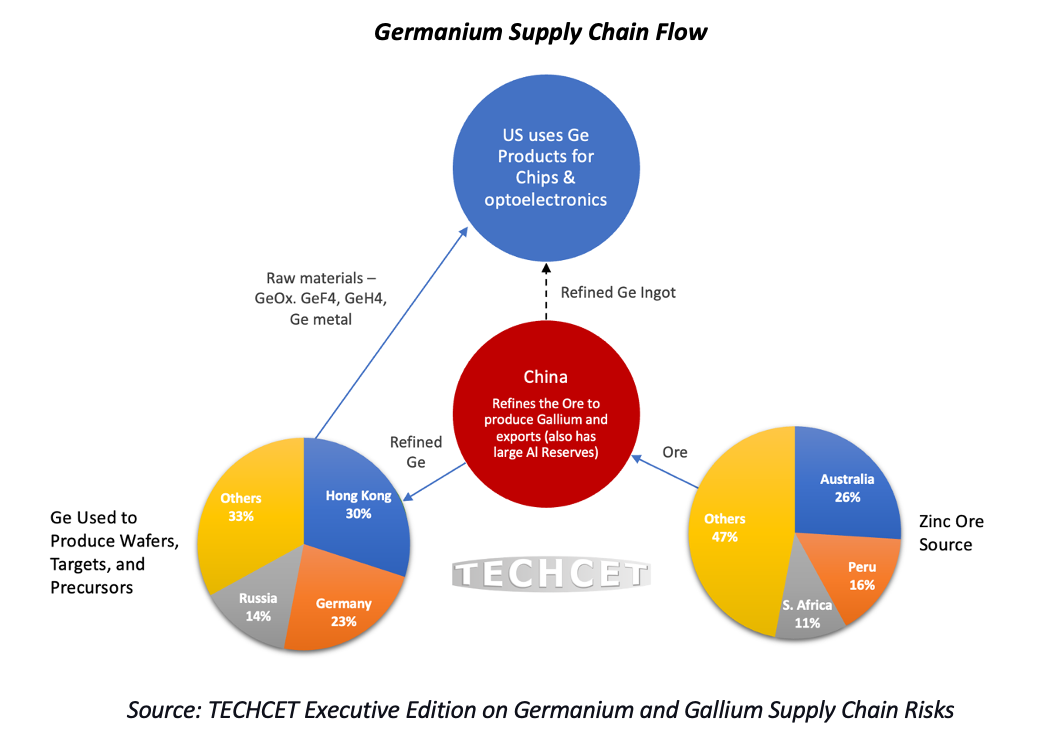

San Diego, CA, October 12, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — has uncovered a significant supply chain risk for germanium and gallium for the global semiconductor market. Both germanium and gallium are critical metals essential to producing RF and sensor devices, 5G, IT communications, and automotive applications. China is the world’s leading producer of refined germanium and gallium, which has increased risk for the US semiconductor supply chain. Global supply risks have been further amplified by recent announcements from China regarding export permit requirements for both metals, as explained in TECHCET’s new Report on Germanium and Gallium Supply Chain Risks. TECHCET’s new Report on Germanium and Gallium Supply Chain Risks.

While there are other reserves and capacities for germanium and gallium outside China, producing viable material would require significant investment and time. Any reduction in gallium supply from China over the next 1-3 years poses an issue for the US. China primarily dominates the refining resources required to produce these materials, and the ore emanates from other non-US sources, as shown in the Figure above on germanium.

Ramping up production and capacity for germanium and gallium within the US would help to stabilize the supply of these much-needed metals. However, mineral and chemical companies within the US face various hurdles in justifying the investment in new capacity for these materials. For example, chemical companies in China benefit from support through free or tax-free land, government money, and loans for building plants. US chemical companies do not have these benefits and are burdened with more expensive labor and power costs than offshore alternatives. This results in less willingness for companies to independently expand capacity within the US, indicating a high need for government support or improved trade relations with outside sources.

In the short term, improved trade relations are tantamount to a continued supply of these critical materials. Since building a refining or mining operation requires several years to become productive, it may be wise for the US to cultivate better trade relations with China to ensure current supply needs, while also developing other supply sources from allied nations or domestically within the US. Operating parallel paths would help reduce risk in the short term while working on a longer-term solution to minimize risks to the overall US chip manufacturing supply chain.

For more details on Germanium and Gallium supply chain dependencies and risks, go to: https://techcet.com/product/germanium-and-gallium-supply-chain-risk-executive-edition-single-user-license/.

To discuss more on the supply chains for germanium, gallium, and other semiconductor materials, come talk to TECHCET at the CMC Seminar in Taichung, Taiwan on October 25th. For more information and to register, go to: https://cmcfabs.org/2023-cmc-seminar/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact cmcinfo@techcet.com, +1-480-332-8336, or go to www.techcet.com.