Description

Click here for a PDF download of the full table of contents

[If you are only interested the US Chip Expansion portion of this report please contact us by clicking here.]

Featured Press Release on US Chemical Supply-Chain Impact Report Highlights:

1.0 EXECUTIVE SUMMARY 11

1.1 EXECUTIVE SUMMARY – EXPANSIONS HAVE A MAJOR IMPACT

ON WAFER STARTS 12

1.2 EXECUTIVE SUMMARY – CHEMICAL DEMAND GROW ACCELERATES 13

1.3 EXECUTIVE SUMMARY – MATERIALS INCREASES ACROSS

THE SPECTRUM 14

1.4 EXECUTIVE SUMMARY – CAPACITY SHORTFALLS EXPECTED 15

1.5 EXECUTIVE SUMMARY – IMPORT DEPENDENCIES 16

1.6 EXECUTIVE SUMMARY – BY CHEMICAL (NO SIGNIFICANT

CHANGE FROM 2022) 17

1.7 EXECUTIVE SUMMARY – “IMPORT FIRST, BUILD LATER” 18

2.0 THE CURRENT STATE OF AFFAIRS 19

2.1 SHRINKING DOMESTIC MANUFACTURING 20

2.2 GLOBAL MARKET SHARE BY COUNTRY 21

2.3 GLOBAL DYNAMICS IMPACT INDUSTRY OUTLOOK 22

2.4 MATERIAL MARKETS REMAIN SIGNIFICANT 23

2.5 IMPACT OF US CHIP EXPANSION ON WET CHEMICAL DEMAND 24

2.6 WET CHEMICAL DEMAND INCREASE LED BY LOGIC MANUFACTURING 25

2.7 ADVANCED DEVICES DRIVE MATERIALS INCREASES 26

2.8 CURRENT SUPPLIERS – SUPPLY CHAIN CHARACTERISTICS 27

2.8.1 CURRENT SUPPLIERS – MARKET RANKINGS 28

2.8.2 CURRENT SUPPLIERS – MARKET DYNAMICS 29

2.8.2 CURRENT SUPPLIERS – MARKET DYNAMICS, CONTINUED 30

3.0 THE FORECAST CHANGES TO THE STATUS QUO 31

3.1 ANNOUNCED AND PLANNED FAB EXPANSIONS UPDATE 32

3.2 CHIPS AND SCIENCE ACT OF 2022 35

3.3 CHIPS ACT PROVISIONS 36

3.4 NEW FABS IN THE US 37

3.5 US FAB/PLANT EXPANSION ACTIVITY 38

3.6 US CHIP EXPANSION EFFECT ON CAPACITY 39

3.7 CHIP EXPANSION CHANGES IN WET CHEMICAL DEMAND 40

3.8 WET CHEMICAL DEMAND – A STRONG MESSAGE TO SUPPLIERS 41

4.0 SUPPLY, DEMAND & CAPACITY 42

4.1 DEFINITIONS OF THE TERMS USED THROUGHOUT THIS REPORT 43

4.2 SEMICONDUCTOR EXPANSION DRIVES MATERIALS

DEMAND GROWTH 44

4.3 CAPACITY SHORTFALLS EXPECTED 45

4.4 CHEMICAL DEMAND FORECAST, MANUFACTURING

CAPABILITIES & GAP 46

4.5 PURITY OVERVIEW 47

4.6 DOMESTIC FAB EXPANSION PLANS ACCELERATE 48

4.7 DEMAND GROWTH BY WET CHEMICAL TYPE 49

4.8 CHEMICAL VOLUME DEMAND GROWS BY 75% 50

4.9 WET CHEMICAL SUPPLY/DEMAND FORECASTS 51

4.9.1 SULFURIC ACID (H2SO ) OUTLOOK 52

4.9.1.1 US IMPORTS OF UHP H2SO4 53

4.9.1.2 H2SO4 US MARKET LANDSCAPE 54

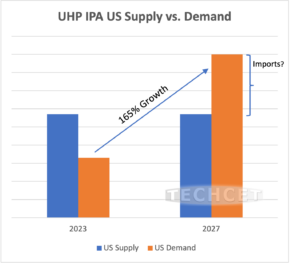

4.9.2 ISOPROPYL ALCOHOL (IPA) OUTLOOK 55

4.9.2.1 US IMPORTS OF UHP IPA 56

4.9.2.2 IPA US MARKET LANDSCAPE 57

4.9.3 HYDROGEN PEROXIDE (H2O2) OUTLOOK 58

4.9.3.1 US IMPORTS OF UHP H2O2 59

4.9.3.2 H2O2 US MARKET LANDSCAPE 60

4.9.4 HYDROCHLORIC ACID (HCL) OUTLOOK 61

4.9.4.1 US IMPORTS OF UHP HCL 62

4.9.4.2 HCL US MARKET LANDSCAPE 63

4.9.5 AMMONIUM HYDROXIDE (NH4OH) OUTLOOK 64

4.9.5.1 US IMPORTS OF UHP NH4OH 65

4.9.5.2 NH4OH US MARKET LANDSCAPE 66

4.9.6 HYDROFLUORIC ACID (HF) OUTLOOK 67

4.9.6.1 US IMPORTS OF UHP HF 68

4.9.6.2 HF US MARKET LANDSCAPE 69

4.9.7 PHOSPHORIC ACID (H3PO4) OUTLOOK 70

4.9.7.1 US IMPORTS OF UHP H3PO4 71

4.9.7.2 H3PO4 US MARKET LANDSCAPE 72

4.9.8 NITRIC ACID (HNO3) OUTLOOK 73

4.9.8.1 US IMPORTS OF UHP HNO3 74

4.9.8.2 HNO3 US MARKET LANDSCAPE 75

4.10 KEY SUPPLIERS SUMMARY 76

5.0 ANTICIPATED MARKET ADJUSTMENTS 77

5.1 ANTICIPATED MARKET ADJUSTMENTS 78

5.2 ANTICIPATED ACTIONS 79

5.3 SUPPLIER US PLANT EXPANSION ACTIVITY 80

5.4 THE SAMSUNG/TSMC EFFECT 83

5.5 COMMENTS FROM THE PARTICIPANTS 84

6.0 DEPENDENCIES & CHALLENGES OF IMPORTS 87

6.1 US DEPENDENCE ON WET CHEMICAL IMPORTS 88

6.2 A CHANGING IMPORT PICTURE 89

6.3 “TO IMPORT OR NOT TO IMPORT, THAT IS THE QUESTION” 91

7.0 PACKAGING & PURITY 95

7.1 EVOLVING PACKAGING REQUIREMENTS 96

7.2 ULTRA HIGH PURITY DEMANDS – A LIABILITY OR OPPORTUNITY? 97

7.3 CHEMICAL PURITY TRENDS 98

7.3.1 EVER INCREASING PURITY REQUIREMENTS 99

7.4 SHIP TO CONTROL & EVOLVING REQUIREMENTS 100

8.0 TECHCET’S ASSESSMENT OF RISKS AND OPPORTUNITIES 101

8.1 TECHCET’S ASSESSMENT – GENERAL OBSERVATIONS 102

8.2 TECHCET’S ASSESSMENT – INTERNATIONAL CONSIDERATIONS 103

8.3 TECHCET’S ASSESSMENT – SUPPLIER CONCERNS 104

APPENDIX A: MANUFACTURING UHP CHEMICALS 105

FIGURES

FIGURE 1: 2023 US CHIP FAB CAPACITY - 33.9 M WAFERS

(200MM EQUIV.) 12

FIGURE 2: 2027 US CHIP FAB CAPACITY - 46.4 M WAFERS

(200MM EQUIV.) 12

FIGURE 3: US ANNUAL WAFER CAPACITY FORECAST 2023-2027

(200MM EQUIV.) 14

FIGURE 4: SEMICONDUCTORS LEAD US EXPORTS 20

FIGURE 5: US SEMICONDUCTOR INDUSTRY IS STRONG, DESPITE

LIMITED MANUFACTURING PRESENCE. (REVENUES AS A

PERCENT

OF TOTAL SALES BY HQ LOCATION) 21

FIGURE 6: 2022 GLOBAL SEMICONDUCTOR MATERIALS MARKET

BY SEGMENT (US$71.7B) 23

FIGURE 7: US WET CHEMICAL DEMAND BY CHIP FABRICATOR

2023-2027 (200MM EQUIV. WAFERS) 24

FIGURE 8: US WAFER START CAPACITY FOR LOGIC DEVICES BY

NODE, 2023-2027 (200MM EQUIV. WAFERS) 25

FIGURE 9: US WAFER CAPACITY FOR MEMORY DEVICES BY NODE,

2023-2027 (200MM EQUIV. WAFERS) 26

FIGURE 10: SEMICONDUCTOR DEMAND AS A PERCENT OF TOTAL 30

FIGURE 11: INVESTMENT IN GLOBAL CHIP EXPANSIONS 2022-2027

($500 B USD) 32

FIGURE 12: US CHIP EXPANSIONS 2023-2027 37

FIGURE 13: CHIP EXPANSION EXPECTED TO GROW ANNUAL

CAPACITY >35% TO 46.4M (200MM EQUIV.) 39

FIGURE 14: WET CHEMICAL DEMAND WILL RISE 75% FROM

LEADING CHIP FABS 2023-2027 41

FIGURE 15: US WAFER START GROWTH BY DEVICE TYPE AND NODE 48

FIGURE 16: US 2023 – 2027 US WET CHEMICAL DEMAND FORECAST 49

FIGURE 17: US H2SO4 SUPPLY VS. DEMAND VOLUME (MKG) 52

FIGURE 18: US H2SO4 UHP GRADE – DEPENDENCE ON IMPORTS 53

FIGURE 19: US H2SO4: 71% GROWTH, 11% CAGR 54

FIGURE 20: US SUPPLY VS. DEMAND VOLUME (MKG) 55

FIGURE 21: US IPA UHP GRADE – INCREASING DEPENDENCE

ON IMPORTS 56

FIGURE 22: US IPA VOLUME DEMAND 92% GROWTH 14% CAGR 57

FIGURE 23: US H2O2 SUPPLY VS. DEMAND (MKG) 58

FIGURE 24: US H2O2 UHP GRADE – DEPENDENCE ON IMPORTS 59

FIGURE 25: US H2O2 US VOLUME DEMAND 80% GROWTH 13% CAGR 60

FIGURE 26: US HCL SUPPLY VS. DEMAND (MKG) 61

FIGURE 27: US HCL UHP GRADE – DEPENDENCE ON IMPORTS 62

FIGURE 28: US HCI US DEMAND 70% GROWTH 11% CAGR 63

FIGURE 29: US NH4OH SUPPLY VS. DEMAND (MKG) 64

FIGURE 30 US NH4OH UHP GRADE DEPENDENCE ON IMPORTS 65

FIGURE 31: US NH4OH US VOLUME DEMAND 77% GROWTH

12% CAGR 66

FIGURE 32: US HF SUPPLY VS. DEMAND (MKG) 67

FIGURE 33: US HF UHP GRADEDEPENDENCE ON IMPORTS 68

FIGURE 34: US HF VOLUME DEMAND 59% GROWTH, 10% CAGR 69

FIGURE 35: US H3PO4 SUPPLY VS. DEMAND (MKG) 70

FIGURE 36: US H3PO4 UHP GRADE - DEPENDENCY ON IMPORTS 71

FIGURE 37: US H3PO4 US VOLUME DEMAND79% GROWTH,

12% CAGR 72

FIGURE 38: US HNO3 SUPPLY VS. DEMAND (MKG) 73

FIGURE 39: US HNO3 UHP GRADE - DEPENDENCE ON IMPORTS 74

FIGURE 40: US HNO3 US VOLUME DEMAND 33% GROWTH, 6% CAGR 75

FIGURE 41: RENDERING OF TSMC’S ARIZONA FACILITY 78

FIGURE 42: CHINA TO US OCEAN FREIGHT EXPORT PRICE TRENDS 79

FIGURE 43: SHIP TO CONTROL FOR PROCESS CHEMICALS EXAMPLE 100

TABLES

TABLE 1: CHEMICAL VOLUME GROWTH 2023-2027 13

TABLE 2: US WET CHEMICAL EXCESS/SHORTFALLS EXPECTED 15

TABLE 3: DEPENDENCY OF UHP PRODUCTS ON IMPORTS

WITHOUT

ADDITIONAL DOMESTIC CAPACITY 16

TABLE 4: US DOMESTIC TIER I TOP 3 SUPPLIERS BY

VOLUME SUPPLIED 28

TABLE 5: US FAB RAMP FORECAST (200MM EQUIV.) 38

TABLE 6: WET CHEMICALS WITH THE HIGHEST DEMAND GROWTH

IN THE US 2027/2023 44

TABLE 7: CAPACITY SHORTFALLS EXPECTED (SAME AS TABLE 2) 45

TABLE 8: UHP AND IC GRADE SPLIT USED FOR GRAPHS 46

TABLE 9: US SEMICONDUCTOR CHEMICAL VOLUME GROWTH

2027/2023 50

TABLE 10: SUMMARY OF KEY US SUPPLIERS 76

TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY,

PAGE 1 OF 3 80

TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY,

PAGE 2 OF 3 81

TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY,

PAGE 3 OF 3 82

TABLE 12: COMMENTS FROM THE SELECTED PARTICIPANTS 85

TABLE 12: COMMENTS FROM THE SELECTED PARTICIPANTS,

CONTINUED 86

TABLE 13: 2027 IMPORTS AS A PERCENTAGE OF UHP AND

TOTAL DEMAND 89

TABLE 14: INCREASING DEPENDENCY OF UHP PRODUCTS

ON IMPORTS 90

TABLE 15: EVOLVING PACKAGING REQUIREMENTS 96

TABLE 16: PURITY REQUIREMENTS 99

TABLE 17: COMMENTS FROM THE SELECTED PARTICIPANTS 109

TABLE 17: COMMENTS FROM THE SELECTED PARTICIPANTS,

CONTINUED 110