Description

This report is focused on silicon carbide (SiC) wafers used to make semiconductor devices, and includes market drivers, wafer forecast, wafer making landscape and supplier activities. Additionally, it provides a comprehensive look at wafer making including manufacturing costs as well as what is required to estimate consumable and capital expenditures needed to build out a wafer making facility.

Featured Press Release on Silicon Carbide Market Updates and Report Highlights:

Table of Contents:

Click here for a PDF download of the full table of contents

1 Executive Summary 9

1.1 SiC Wafer Market Overview 9

1.2 Silicon Carbide Market Drivers 10

1.3 Other Wide Bandgap (WBG) Semiconductor Materials 10

1.4 Supplier Activities 11

1.5 General Comments 11

2 Scope, Purpose and Methodology 13

2.1 Scope 13

2.2 Purpose 13

2.3 Methodology 13

2.4 Overview of Other TECHCET CMR™ Reports 14

3 SiC Wafer Market Outlook 15

3.1 Silicon Carbide End-Use Application

Market Drivers 15

3.1.1 Market Driver: Electric Vehicles &

Charging Stations 17

3.1.2 Market Driver: Data Centers and Power Devices 21

3.1.3 Market Driver: 5G Communications 25

3.2 Semiconductor Device Manufacturing

Market Drivers 26

3.2.1 Inverter Modules 27

3.2.2 Power Devices Forecast (Diodes and MOSFETs). 27

3.2.3 Power Inverter Modules (for EV’s) 29

3.3 Summary of SiC Market Drivers 29

3.4 Potentially Disruptive Technologies – GaN,

Ga Oxide 29

4 Silicon Carbide Market Landscape 31

4.1 Economic and Industry Trends 31

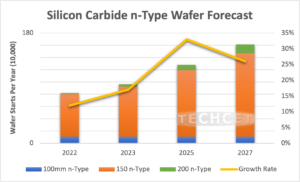

4.2 SiC Wafer Forecast 33

4.2.1 N-Type Wafer Forecast 34

4.2.2 Semi-Insulating Wafer Forecast 36

4.3 SiC Wafer Suppliers and Market Shares 37

4.4 Supplier Activities – M&A 39

4.5 Comments on Regional and Global Trends 39

5 SiC Wafer Manufacturing Costs and Considerations 41

5.1 Brief History of SiC as a Semiconductor

Substrate 41

5.2 SiC Material Properties 44

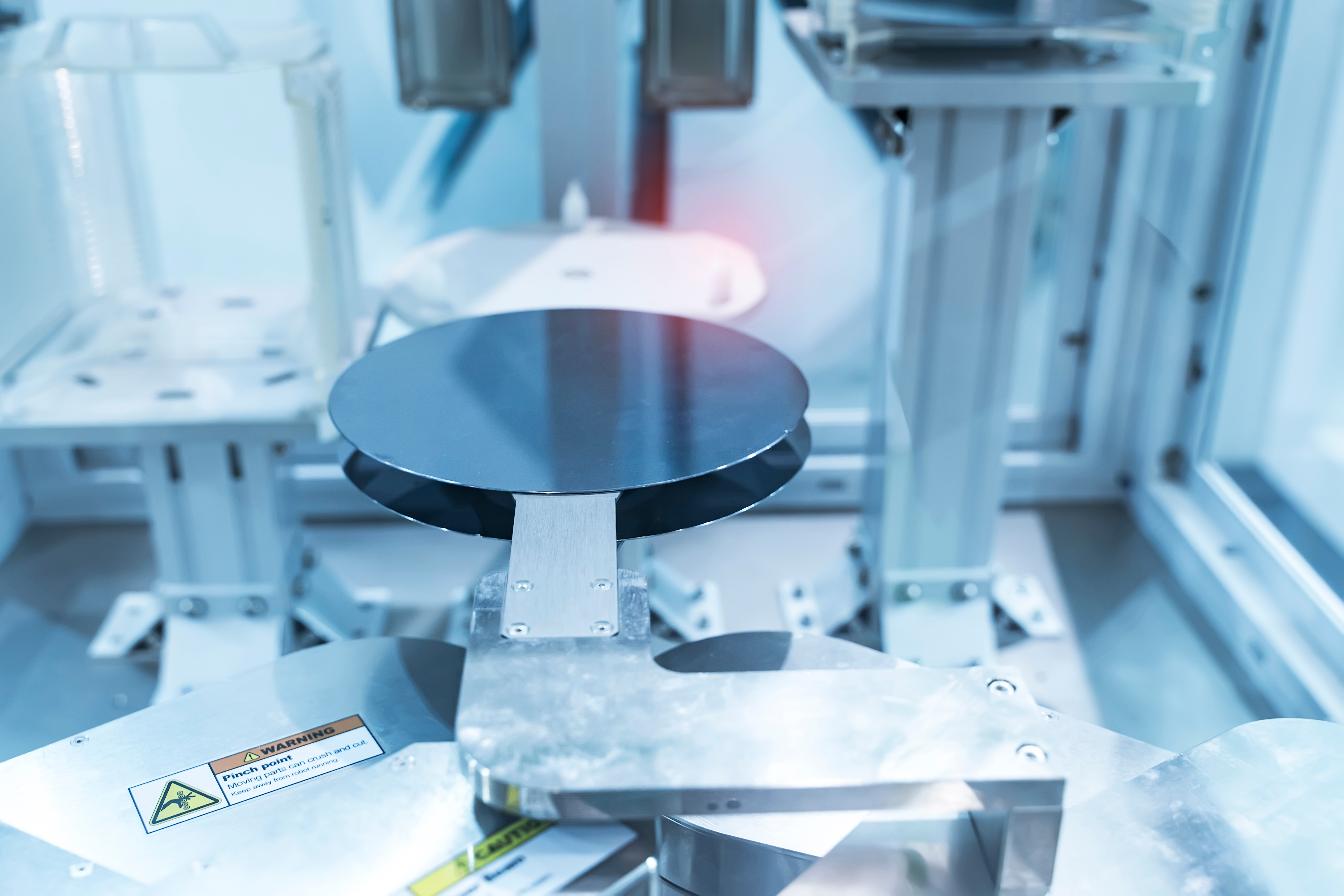

5.3 SiC Wafering Process Flow 46

5.3.1 SiC Wafering Sequence 46

5.3.2 SiC Boule Growth 47

5.4 SiC Wafer Manufacturing Cost Breakdown 48

5.4.1 SiC Furnace Capacity Planning 51

5.4.2 SiC Crystal Growth Consumables 53

5.4.3 OD Grinding (and puck grinding if needed) 54

5.4.4 Wafer Slicing 57

5.4.5 Edge Grinding 61

5.4.6 Pre-Polishing 64

5.4.7 Polishing/CMP and Cleaning 69

5.4.8 Epitaxy 73

5.4.9 Comments regarding OEM landscape

for process equipment 74

6 Supply Chain and Company Profiles 76

6.1 Raw Material Dependencies and Concerns 76

6.2 SiC Wafer Suppliers 77

6.3 SiC Device Manufacturers 78

6.4 Process Equipment Suppliers (OEM’s) 79

6.5 SiC Process Consumables 80

6.6 Company Profiles 81

7 Summary and closing comments 82

8 Appendices 84