Quartz, Ceramic, and Silicon Equipment Components

Semiconductor fab expansion met with pause before strong rise in 2025

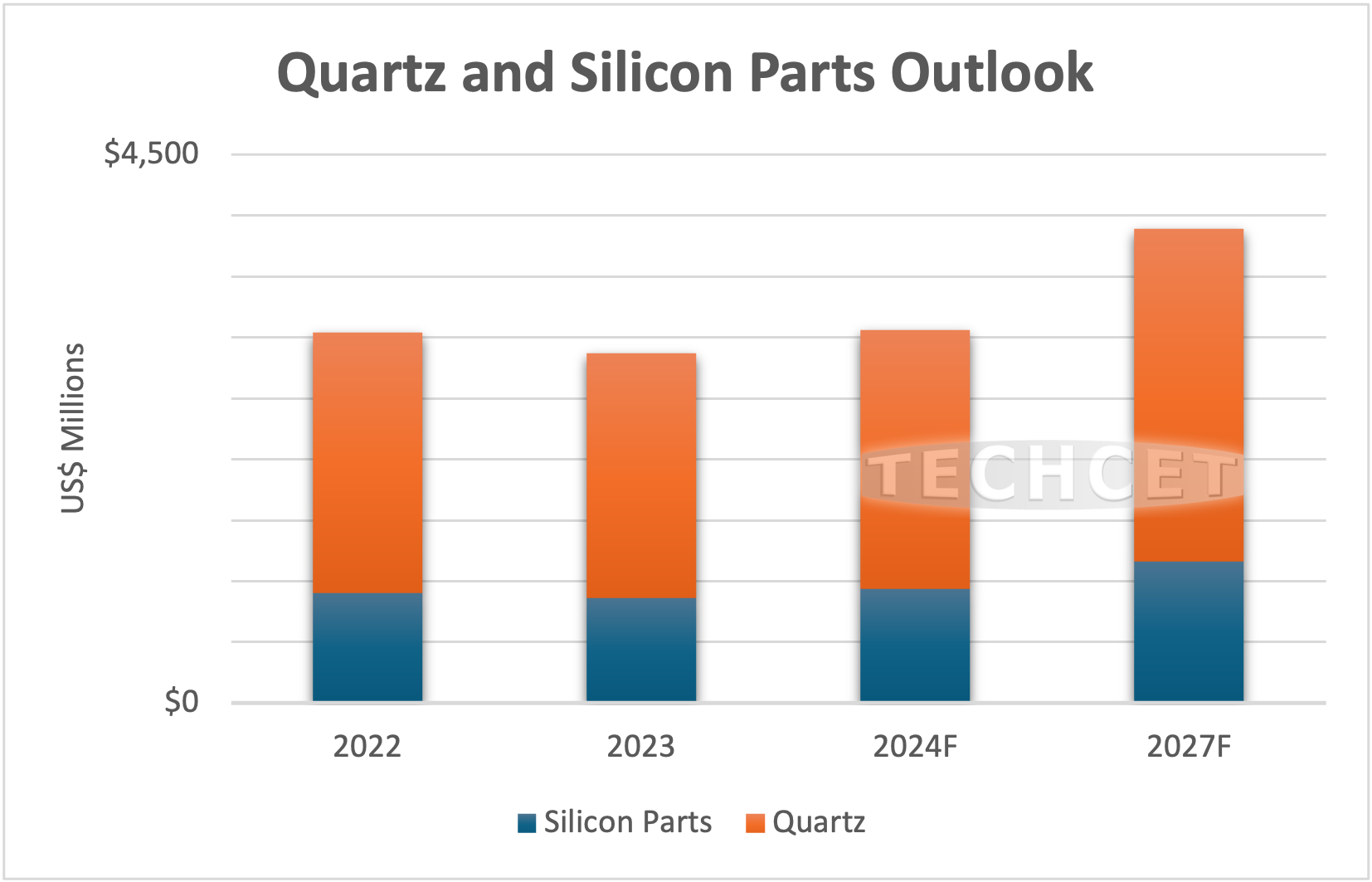

San Diego, CA, February 6, 2024: TECHCET — the advisory firm providing materials market & supply chain information for the semiconductor industry — reports that the total Semiconductor Quartz and Silicon Parts markets will show moderate growth of less than 5% to US$2.95 billion in 2024. This outlook is attributed to a slowing in fab expansion plans and an expected strong recovery in equipment spending pushed out to 2025. 2023 was a challenging correction year for the market, as the combined revenues for the two segments contracted 6% to US$2.87 billion. This decline followed a remarkable 28% growth observed in 2022, fueled by the strong expansion of the semiconductor equipment market. More detailed information can be found in TECHCET’s Equipment Components Critical Material Reports™ here: (https://techcet.com/product-category/equipment-components/).

In recent years, supply chain issues have reigned in these two market segments, with the main issue now centering around bilateral trade conflicts (e.g., China-U.S.). These concerns have triggered a renewed focus on securing localized supply chains of critical materials in all markets, or identifying alternative suppliers from different markets. For example, the US has limited local companies exporting 14 nm and below semiconductor equipment to China; thus, local Chinese suppliers need to find solutions to deliver sales to customers. It is believed that domestic suppliers who have overseas sales will redirect their focus to supplying local Chinese fabs because of more demand and lower quality requirements. More information on these supply chain topics will be discussed at the 2024 CMC Conference in Chandler, AZ on April 10-11 (https://cmcfabs.org/2024-cmc-conference/).

“The theme of the semiconductor quartz component market segment has been to keep producing while proceeding with caution, and minimizing expansion investment” states Lita Shon-Roy, President and CEO at TECHCET. As the industry recovers, there will be a greater need to ramp up quartz material production to meet the rising demand for advanced process nodes from semiconductor equipment makers and fabs. Previous backlogs have been fulfilled and lead-times are now more reasonable. Prior expansion plans for quartz already occurred in part during 2022, which may have resulted in some excess capacity in 2H 2023. Looking into 2024, production plans will utilize 2023 unused capacity as the semiconductor industry tries to resume and incoming chip fab investments and equipment demands move forward.

From a supply chain standpoint, up to 50% of silicon parts sales are tied to new etch or deposition tool purchases from equipment makers, while the remaining 50% are direct sales of replacement parts. A recovery in the equipment market is anticipated to boost demand for parts in 2024, especially as new fabs ramp up. In 2025, strong demand will be driven by increased etch and deposition steps for 3DNAND and leading-edge logic devices. Addressing supply tightness will require industry players to leverage established practices such as long-term agreements and strategic partnerships with parts fabricators. Silicon parts fabricators have and will continue to boost in-house ingot growing capacity dedicated to the silicon parts fabrication only. Many fabricators have developed their own silicon growing capabilities within the past 15 years, which has strengthened their ability to support demand for equipment parts.

For the full table of contents and to purchase the Equipment Components Critical Materials Reports™, visit https://techcet.com/product-category/equipment-components/

To get more market and supply chain information on Silicon Parts and Quartz Equipment Components, don’t miss the 2024 CMC Conference in Chandler, AZ on April 10-11. For more info and to register, visit https://cmcfabs.org/2024-cmc-conference/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please email us here, call +1-480-332-8336, or go to www.techcet.com.