Demand to outpace supply for NF3 and WF6 unless alternatives come into play

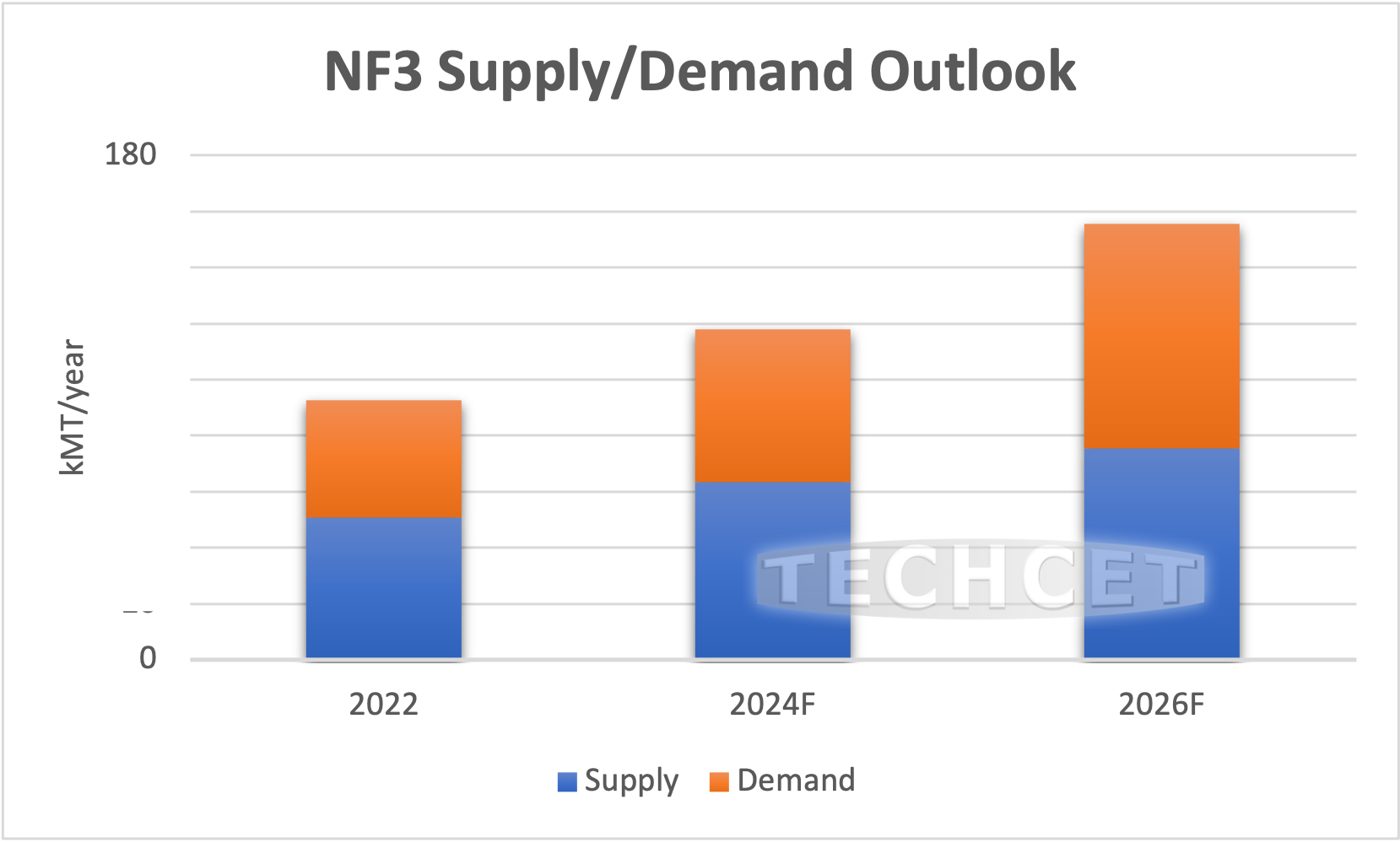

San Diego, CA, August 31, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— reports that the supply of Specialty Gases, nitrogen trifluoride (NF3) and tungsten hexafluoride (WF6) for electronics could tighten amongst high projected demand by 2025-2026. This forecasted steep trajectory will challenge supply-chains to keep pace. However, alternatives being developed could interrupt this trend. Both NF3 and WF6 are part of a larger US$5 billion specialty gas segment forecasted to grow 30% over the next 5 years, to total US$6.5 billion by 2026. As shown below, NF3 is expected to grow even more steeply, 72% over the forecast period (as highlighted in TECHCET’s 2022 Critical Materials Report™ on Electronic Gases).

Alternatives for these gases are currently in development which could cause a shift in growth trends. The increasing demand for NF3 in electronic manufacturing, including flat-panel displays, has triggered concern among atmospheric scientists over emissions of nitrogen trifluoride, a potent greenhouse gas. Particularly, NF3 gas has a high Global Warming Potential (GWP) compared to other gases. Consequently, the electronics industry is looking at and considering processes for on-site fluorine generation that can use F2, in place of NF3, for chamber cleaning.

Demand for WF6, although increasing in conductor applications for 3DNAND production, is not ideal in its performance for advanced memory. Currently, memory makers are researching new processes which use Molybdenum (Mo) as an alternative to tungsten for the conductor in hopes of improving performance. Thus, there is a potential to replace WF6 over the next several years. If Mo deposition processes (using solid precursors) can be successfully developed, then the transition from R&D to high volume manufacturing could occur by 2025. This will then shift market share away from the WF6 segment. However, information on implementation is still uncertain since no Mo precursor product has been found in the field, and device makers have not made any official announcements concerning a change in conductor material. If Mo materials and processes can match the cost of ownership to replace W, it could grow rapidly and diminish future WF6 demand.

Among the sources of electronic gases highlighted in TECHCET’s CMR are Air Products, Air Liquide, EMD / Merck, Linde, Matheson Gas, SK Materials, Gazprom, Huate Gas, Peric, and many others. For more details on the Electronic Gases market segments and growth trajectory go to: https://techcet.com/product/gases/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.