US Semiconductor Wet Chemicals Supply-Chain Restructuring to accommodate Chip Expansions

Supply-demand gaps will exist unless more domestic production is developed

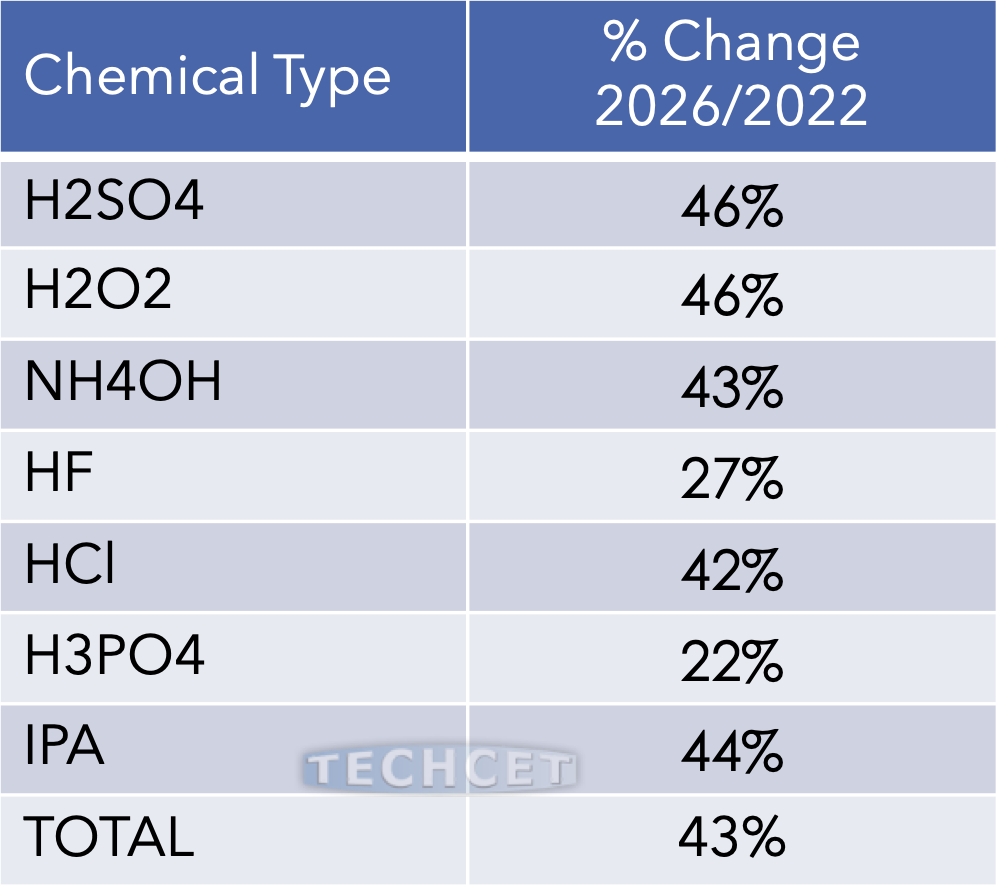

San Diego, CA, November 16, 2022: TECHCET—the advisory firm providing electronics and semiconductor materials market supply-chain information—forecasts that the US Basic Wet Chemicals demand will exceed 210 K metric tons in 2022, as highlighted in TECHCET’S most recent study on the US Chip Expansion Impact on the Wet Chemical Supply-Chain. This increase in demand is expected to run into a supply crunch as chip fabs ramp in demand by 2026, especially due to increased interest in US fab expansions, acquisitions, and joint ventures following the recent passage of the US CHIPS Act. While chemical suppliers have been announcing their commitment to support these expansions, it is still unclear whether it will be enough to meet the growing demand. Announcements for new chemical facilities have been announced by Kanto / Chemtrade, ChanChung, Sunlit, and MGC, to name a few. Estimates on volume demand from chip expansions is provided below:

Growth in Chemical Demand Expected to Support US Chip Expansions

Note: several of the chip fabs that are included in these estimates will not be fully ramped until 2028. Therefore, chemical demand will grow even larger than what is stated above.

“The expansion announcements by material suppliers show positive domestic support for new H2SO4 and H2O2 capacity, while UHP HF and IPA may continue to be supported with imported material until volumes and pricing can justify full plant investments,” states Lita Shon-Roy, President and CEO of TECHCET. As a result, TECHCET expects to see continued supply constraints in these areas until container and shipping availability stabilizes and inventory management adjusts to the new volumes.

For NH4OH, 45% more volume will be required by 2026. This increased demand could be supported by local production, but commitments for expansions and new capability have yet to be publicly announced. For high purity chemicals like HNO3 and H3PO4, increasing local production has been a challenge as old plants have been shut down over the years without any new facilities to replace them. As a result, imports have started to increase. The small demand volumes associated with these two chemicals may make imports more attractive to suppliers, rather than building a new plant that has poor ROI and may encounter challenges associated with stringent US environmental regulations.

The risk of US recession will also invariably impact short term demand. However, given CHIPS Act funding and the persistent growing need for more semiconductor devices for modern technology, demand for consumer products is expected to continue on a steep growth curve over the next decade.

For more details on the Impact on the Wet Chemical Supply Chain from US Chip Expansions go to:

https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain-3/

ABOUT TECHCET: TECHCET CA LLC is an advisory research firm focused on analyzing the electronics materials supply chains for the global semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, supply chain analysis reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.