CMP Consumables US$2.5B in 2020 for IC Fabs

Stable world-wide growth in demand forecasted through 2024

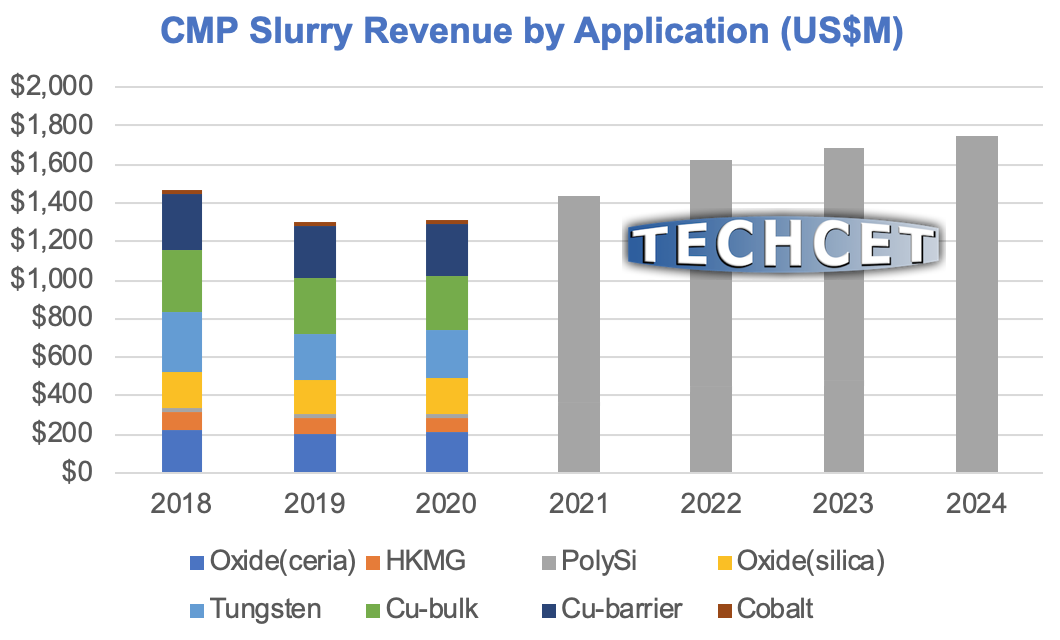

San Diego, CA, August 27, 2020: TECHCET—the electronic materials advisory firm providing business and technology information—announces that the global market for chemical-mechanical planarization (CMP) consumable materials in semiconductor manufacturing is expected to total over US$2.5 billion this year. CMP consumables including slurries, pads, and conditioning disks are all in stable supply globally, despite COVID-19 pandemic disruptions. The total sub-market just for CMP slurries is forecast to be US$1.3 billion this year, with a Compound Annual Growth Rate (CAGR) of 6.2% per year over the period 2020-2024, as shown in the figure from TECHCET’s 2020 CMP Consumables: Slurry, Pads, and Conditioning Disks Markets for Semiconductor Applications report (below).

While the 2020 CMP slurry market will be down ~2.2% from 2019 levels, ongoing demand for both logic and memory IC fabs is expected to drive steady growth through 2024. For logic chips, the largest demand segments are for copper-bulk, copper-barrier, tungsten, and shallow trench isolation (STI), while slurries for HKMG and cobalt are highly value-added despite relatively lower volume demands. For memory chips, increases in the number of layers in 3D-NAND chips drives continued rapid growth in demand for tungsten slurry as well as ceria slurry for high-rate oxide planarization steps.

“Showa Denko’s recent acquisition of Hitachi Chemical was another sign of a maturing semiconductor materials supply-chain,” commented Dr. Diane Scott, TECHCET Analyst and co-author of the report. “This business unit is the world’s leader in supplying ceria slurry, a highly specialized formulation using Rare Earth Oxide nanoparticles to make ultra-smooth surfaces for the world’s most advanced ICs.”

The CMP consumables market is seeing increased focus on localization of the supplychain, with many suppliers looking at finishing product closer to the end-users. Finishing refers to final production steps of the material, which in the case of pads could include application of adhesives, cleaning, quality control (QC) inspections, and specialized clean packaging for shipment. Benefits include reduced shipping cost, faster customization, and localized buffer-inventory to support demand surges.

Critical Materials Reports and Market Briefings: TECHCET Shop