Description

This report looks at the market drivers for pad conditioners, retaining rings, slurry filters, and PVA brushes and forecasts by application market shares suppliers. CMP processes are critical to semiconductor manufacturing as process integration requires the fabrication of thin and uniformly flat layers to build up device structures across the semiconductor wafers. The number of CMP process steps continue to increase with each generation of new device technology. New device technology is characterized by more layers new materials tighter process control requirements and new techniques for advanced packaging.These manufacturing challenges require new and continued optimization for CMP processes.

Featured Press Release on CMP Ancillaries Market Updates and Report Highlights:

Table of Contents:

Click here for a PDF download of the full table of contents

1 EXECUTIVE SUMMARY 9

1.1 CMP ANCILLARIES MARKET OVERVIEW 10

1.2 CMP ANCILLARIES REVENUE TRENDS 11

1.3 MARKET TRENDS IMPACTING CMP ANCILLARIES OUTLOOK 12

1.4 YEAR 2022 IN REVIEW AND FIVE-YEAR FORECAST 13

1.5 CMP ANCILLARIES FORECASTS BY MATERIAL SEGMENT 14

1.5.1 CMP PAD CONDITIONERS 5-YEAR REVENUE FORECAST 15

1.5.2 CMP SLURRY POINT OF USE (POU) FILTERS 5-YEAR

REVENUE FORECAST 16

1.5.3 CMP PVA BRUSHES FOR POST CMP CLEANS 5-YEAR

REVENUE FORECAST 17

1.5.4 CMP WAFER RETAINING RINGS 5-YEAR

REVENUE FORECAST 18

1.6 TECHNOLOGY TRENDS 19

1.7 PAD CONDITIONERS SUPPLIER COMPETITIVE LANDSCAPE 20

1.8 POINT-OF-USE (POU) SLURRY FILTERS SUPPLIER

COMPETITIVE LANDSCAPE 21

1.9 PVA BRUSH FOR POST-CMP CLEANS SUPPLIER

COMPETITIVE LANDSCAPE 22

1.10 RETAINING RINGS FOR WAFER POLISH HEADS

SUPPLIER COMPETITIVE LANDSCAPE 23

1.11 ANALYST ASSESSMENT 24

2 SCOPE AND METHODOLOGY 26

2.1 SCOPE 27

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 28

3.1 WORLDWIDE ECONOMY 29

3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 31

3.1.2 SEMICONDUCTOR SALES GROWTH 32

3.1.3 TAIWAN MONTHLY SALES TRENDS 33

3.1.4 UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023 - SLOWER TO

NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED 34

3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 35

3.2.1 SMARTPHONES 36 3.2.2 PC UNIT SHIPMENTS 37

3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS 38

3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS 39

3.2.3 SERVERS / IT MARKET 40

3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 41

3.3.1 FAB EXPANSION ANNOUNCEMENT SUMMARY 42

3.3.1.2 NEW FABS IN THE US 43

3.3.2 WW FAB EXPANSION DRIVING GROWTH 44

3.3.3 EQUIPMENT SPENDING TRENDS 45

3.3.4 TECHNOLOGY ROADMAPS 46

3.3.5 FAB INVESTMENT ASSESSMENT 47

3.4 POLICY & TRADE TRENDS AND IMPACT 48

3.5 SEMICONDUCTOR MATERIALS OVERVIEW 49

3.5.1 COULD MATERIALS CAPACITY LIMIT CHIP

PRODUCTION SCHEDULES? 50

3.5.2 LOGISTICS ISSUES EASED DOWN 51 3.5.3 TECHCET WAFER

STARTS FORECAST THROUGH 2027 52

3.5.3.1 TECHCET WAFER START MODELING METHODOLOGY 53

3.5.4 TECHCET’S MATERIAL FORECAST

4 CMP ANCILLARIES MARKET TRENDS 54

4.1 CMP ANCILLARIES MARKET TRENDS 55

4.2 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS 56

4.2.1 3D NAND STACKING 58

4.2.2 TECHNICAL TRENDS IN ADVANCED PACKAGING 59

4.2.3 CMP FOR TSV 61

4.2.4 CMP OF SILICON CARBIDE 62

4.3 REGIONAL TRENDS 63

5 CMP PAD CONDITIONING DISKS STATISTICS & FORECASTS 64

5.1 CMP PAD CONDITIONERS 5-YEAR REVENUE FORECAST 65

5.2 CMP PAD CONDITIONERS 5-YEAR FORECAST BY UNITS 66

5.3 TOTAL PAD CONDITIONERS MARKET SHARE 67

5.4 CMP PAD CONDITIONERS M&A ACTIVITY- ANNOUNCEMENTS

AND PARTNERSHIPS 68

5.5 CMP PAD CONDITIONERS NEW ENTRANTS OR PLANT CLOSURES 69

5.6 CMP PAD CONDITIONERS PRICING TRENDS 70

5.7 TECHCET ANALYST ASSESSMENT OF CMP PAD

CONDITIONERS MARKET 71

6 CMP POU SLURRY FILTER MARKET STATISTICS & FORECASTS 72

6.1 CMP POU SLURRY FILTER 5-YEAR REVENUE FORECAST 73

6.1.1 CMP POU SLURRY FILTERS 5-YEAR FORECAST FORECAST

BY UNITS 74

6.2 CMP POU SLURRY FILTER MARKET SHARE ESTIMAGE 75

6.3 CMPPOUSLURRYFILTERM&AACTIVITY ANNOUNCEMENTS

AND PARTNERSHIPS 77

6.4 TECHCET ANALYST ASSESSMENT 78

7 CMP PVA BRUSH SUPPLIER MARKET STATISTICS & FORECASTS 79

7.1 CMP PVA BRUSH 5-YEAR REVENUE FORECAST 80

7.2 CMP PVA BRUSH 5-YEAR FORECAST BY UNITS 81

7.3 TOTAL PVA BRUSH MARKET SHARE 82

7.4 CMP PVA BRUSH PRICING TRENDS 83

7.4.1 CMP PVA BRUSHES MARKET INFORMATION 84

7.5 TECHCET ANALYST ASSESSMENT OF CMP PVA BRUSH MARKET 85

8 CMP RETAINING RING SUPPLIER MARKET STATISTICS & FORECASTS 86

8.1 CMP RETAINING RING FOR WAFER POLISHING HEADS 5-YEAR

REVENUE FORECAST 87

8.2 CMP RETAINING RING 5-YEAR FORECAST BY UNITS 88

8.3 TOTAL RETAINING RING MARKET SHARE 89

8.4 TECHCET ANALYST ASSESSMENT OF CMP RETAINING RING MARKET 90

9 SUPPLIER PROFILES 91

3M

Abrasive Technology

Ehwa Diamond

Entegris

Kinik

Morgan Advanced Materials

Saesol Diamond

...and many more

10 APPENDIX 181

APPENDIX A: CMP ANCILLARIES OVERVIEW 182

APPENDIX B: TECHCET WAFER START MODELING METHODOLOGY 183

FIGURES

FIGURE1: FORECAST PERCENT OF CMP WAFER PASSES PER YEAR 10

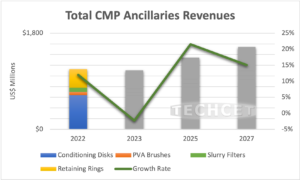

FIGURE 2: TOTAL CMP ANCILLARIES REVENUES ($M USD) 11

FIGURE 3: CMP STEPS FOR ADVANCED DEVICES 12

FIGURE 4: 2022 CMP ANCILLARIES TRENDS/ LESSONS 13

FIGURE 5: EST CMP PROCESS STEPS BY APPLICATION & NODE 14

FIGURE 6: CMP PAD CONDITIONERS REVENUE BY WAFER SIZE 15

FIGURE 7: CMP SLURRY POU FILTERS REVENUE BY APPLICATION 16

FIGURE 8: CMP PVA BRUSH REVENUES BY APPLICATION 17

FIGURE 9: CMP RETAINING RING REVENUES BY WAFER SIZE 18

FIGURE 10: LOGIC DEVICE ARCHITECTURE EVOLUTION 19

FIGURE 11: 2022 PAD CONDITIONERS SUPPLIER MARKET SHARES 20

FIGURE 12: 2022 SLURRY POU FILTERS SUPPLIER MARKET SHARES 21

FIGURE 13: 2022 PVA BRUSH SUPPLIER MARKET SHARES 22

FIGURE 14: 2022 RETAINING RING SUPPLIER MARKET SHARES 23

FIGURE 15: GLOBAL ECONOMY AND THE ELECTRONICS

SUPPLY CHAIN (2022) 31

FIGURE 16: WORLDWIDE SEMICONDUCTOR SALES 32

FIGURE 17: TECHCET’S TAIWAN SEMICONDUCTOR

INDUSTRY INDEX (TTSI)* 33

FIGURE 18: 2023 SEMICONDUCTOR INDUSTRY REVENUE

GROWTH FORECASTS 34

FIGURE 19: 2022 SEMICONDUCTOR CHIP APPLICATIONS 35

FIGURE 20: MOBILE PHONE SHIPMENTS WW ESTIMATES 36

FIGURE 21: WORLDWIDE PC AND TABLET FORECAST 37

FIGURE 22: ELECTRIFICATION TREND BY WORLD REGION 38

FIGURE 23: SEMICONDUCTOR AUTOMOTIVE PRODUCTION 39

FIGURE 24: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B 41

FIGURE 25: CHIP EXPANSIONS 2022-2027 US$360 B 42

FIGURE 26: SEMICONDUCTOR CHIP MANUFACTURING REGIONS

OF THE WORLD 44

FIGURE 27: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (USD B) 45

FIGURE 28: OVERVIEW OF DEVICE TECHNOLOGY ROADMAP 46

FIGURE 29: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST

RENDERING (ON BOTTOM) 47

FIGURE 30: EUROPE CHIP EXPANSION UPSIDE 50

FIGURE 31: PORT OF LA 51

FIGURE 32: TECHCET WAFER START FORECAST BY NODE SEGMENTS** 52

FIGURE 33: GLOBAL SEMICNDUCTOR MATERIALS OUTLOOK 53

FIGURE 34: CMP ANCILLARIES REVENUE FOR 2022 55

FIGURE 35: AVG NUMBER OF CMP STEPS FOR ADVANCED

TECHNOLOGY NODES 56

FIGURE 36: COMPARISON OF METALS RESISTIVITIES BY DIMENSION 57

FIGURE 37: 14NM VS. 7NM METALLIZATION TECHNIQUES 57

FIGURE 38: STACKING FOR 3D NAND 58

FIGURE 39: CMP OPPORTUNITIES IN ADVANCED PACKAGING 59

FIGURE 40: KEY TRENDS IN ADVANCED PACKAGING 60

FIGURE 41: CMP OPPORTUNITIES IN ADVANCED PACKAGING 61

FIGURE 42: SILICON CARBIDE-BASED POWER DEVICE 62

FIGURE 43: ANCILLARIES % REVENUES 2022 REGIONAL HQ 63

FIGURE 44: CMP PAD CONDITIONERS REVENUE BY WAFER SIZE 65

FIGURE 45: FORECASTED PAD CONDITIONERS VOLUME DEMAND 66

FIGURE 46: PAD CONDITIONERS SUPPLIER MARKET SHARES IN 2022 67

FIGURE 47: CMP POU SLURRY FILTERS REVENUE BY SLURRY TYPE 68

FIGURE 48: FORECASTED SLURRY FILTER UNITS DEMAND 69

FIGURE 49: 2022 POU SLURRY FILTER MARKET SHARE 70

FIGURE 50: CMP PVA BRUSH REVENUES BY APPLICATION 80

FIGURE 51: FORECASTED PVA BRUSH UNITS DEMAND 81

FIGURE 52: PVA BRUSH SUPPLIER MARKET SHARES IN 2022 82

FIGURE 53: CMP RETAINING RING REVENUE ($M USD) BY WAFER SIZE 87

FIGURE 54: FORECASTED RETAINING RING UNITS DEMAND 88

FIGURE 55: PAD CONDITIONERS SUPPLIER MARKET SHARES IN 2022 89

FIGURE 56: CMP FOR IC MANUFACTURING PROCESS

TABLES

TABLE 1: GLOBAL GDP AND SEMICONDUCTOR REVENUES* 29

TABLE 2: IMF ECONOMIC OUTLOOK* 30

TABLE 3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES

MARKET SPENDING 2022 40