Description

This report covers the wet chemicals market and supply-chain issues for such used in semiconductor device fabrication. The report contains data and analysis from TECHCET’s data base and Sr. Analyst experience, as well as that developed from primary and secondary market research. This Critical Materials Report™ (CMR) provides focused information for supply-chain managers, process integration and R&D directors, as well as business development managers, and financial analysts. The report covers information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

Featured Press Release on Wet Chemicals Market Updates and Report Highlights:

Table of Contents:

Click here for a PDF download of the full table of contents

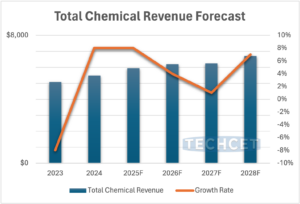

1 EXECUTIVE SUMMARY 12 1.1 2023 CHEMICAL CMR REPORT OVERVIEW 13 1.2 CHEMICAL MARKET OVERVIEW 14 1.2.1 PRICING TRENDS 15 1.3 YEAR 2022 IN REVIEW- 2023 TRENDS/ LESSONS 16 1.4 MARKET TRENDS 17 1.5 SEGMENT VOLUME TRENDS 18 1.6 EHS ISSUES/CONCERNS 19 1.7 ANALYST ASSESSMENT 20 2 SCOPE, PURPOSE AND METHODOLOGY 21 2.1 SCOPE 22 2.2 PURPOSE 23 2.3 METHODOLOGY 24 2.4 OVERVIEW OF OTHER TECHCET CMR™ REPORTS 25 3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 26 3.1 WORLDWIDE ECONOMY 27 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 29 3.1.2 SEMICONDUCTOR SALES GROWTH 30 3.1.3 TAIWAN MONTHLY SALES TRENDS 31 3.1.4 UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023 - SLOWER TO NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED 32 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 33 3.2.1 SMARTPHONES 34 3.2.2 PC UNIT SHIPMENTS 35 3.2.3 SERVERS / IT MARKET 38 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 39 3.3.1 FAB EXPANSION ANNOUNCEMENT SUMMARY 40 3.3.2 WW FAB EXPANSION DRIVING GROWTH 42 3.3.3 EQUIPMENT SPENDING TRENDS 43 3.3.4 TECHNOLOGY ROADMAPS 44 3.3.5 FAB INVESTMENT ASSESSMENT 45 3.4 POLICY & TRADE TRENDS AND IMPACT 46 3.5 SEMICONDUCTOR MATERIALS OVERVIEW 47 3.5.1 COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES? 48 3.5.2 LOGISTICS ISSUES EASED DOWN 49 3.5.3 TECHCET WAFER STARTS FORECAST THROUGH 2027 50 3.5.4 TECHCET’S MATERIAL FORECAST 51 4 WET CHEMICAL MARKET TRENDS 52 4.1 2023 CHEMICAL CMR REPORT OVERVIEW 53 4.2 SUPPLY CAPACITY AND DEMAND, INVESTMENTS 54 4.2.1 CHEMICAL EXPANSIONS I 55 4.2.2 CHEMICAL EXPANSION II 56 4.2.3 CHEMICAL EXPANSION III 57 4.2.4 REGIONAL INVESTMENTS 58 4.2.5 CHEMICAL ANALYSIS JAPAN 59 4.3 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS 60 4.3.1 TECHNOLOGY CHALLENGE 61 4.4 OVERVIEW OF EHS, LOGISTIC, AND ENERGY ISSUES 62 4.4.1 EHS ISSUES 63 4.4.2 LOGISTICS ISSUES 64 4.4.3 ENERGY COSTS 65 4.4.4 WORLD BANK CONCERNS 66 4.4.5 WACKER ENERGY REPORT EUROPE (DECEMBER 2022) 67 4.4.6 EU MANY MATERIALS RESULT FROM REFINERY OPERATIONS 69 4.4.7 IMPACT: BASF MAY HALT PRODUCTION 70 4.4.8 ENERGY INTENSIVE 71 5 BASIC CHEMICALS MARKETS & FORECASTS 72 5.1 TECHCET ANALYST ASSESSMENT - BASIC CHEMICALS 73 5.1.1 PRICING TRENDS – BASIC WET CHEMICALS 74 5.1.2 COMMENTS ON FORECAST MODELING AND METHODOLOGY 75 5.2 MARKET TRENDS 76 5.3 WET CHEMICALS MARKET SEGMENT 77 5.4 BASIC CHEMICAL FORECAST 78 5.5 SUPPLY-CHAIN TRENDS AND HAPPENINGS HIGHLIGHTS 79 5.6 SULFURIC ACID H2SO4 – SECTION OUTLINE 80 5.6.1 H2SO4 OVERVIEW 81 5.6.2 ELECTRONIC GRADE H2SO4 5-YEAR VOLUME FORECAST 82 5.6.3 SULFURIC ACID REVENUE 83 5.6.4 MAJOR SUPPLIERS OR DISTRIBUTORS OF H2SO4 84 5.6.5 SULFURIC ACID SUPPLIERS 85 5.6.6 SULFURIC ACID REGIONAL TRENDS 86 5.6.7 SUPPLY CHAIN- RECYCLE H2SO4 87 5.6.8 ELECTRONIC SULFURIC ACID PRODUCTION 88 5.6.9 CHEMTRADE PRESS ANNOUNCEMENTS 89 5.7 HYDROGEN PEROXIDE H2O2– SECTION OUTLINE 90 5.7.1 H2O2 OVERVIEW 91 5.7.2 HYDROGEN PEROXIDE 5-YEAR FORECAST 92 5.7.3 H2O2 REVENUE FORECAST 93 5.7.4 H2O2 SUPPLIERS 94 5.7.5 H2O2 REGIONAL TRENDS 95 5.7.6 SOLVAY H2O2 PROCESS 96 5.8 PHOSPHORIC ACID H3PO4 – SECTION OUTLINE 97 5.8.1 PHOSPHORIC ACID OVERVIEW 98 5.8.2 H3PO4 5-YEAR VOLUME FORECAST 99 5.8.3 PHOSPHORIC ACID REVENUE 100 5.8.4 H3PO4 MAJOR SUPPLIERS /PRODUCERS 101 5.8.5 H3PO4 MARKET DYNAMICS 102 5.8.6 HSNE MIXTURE 103 5.9 HYDROFLUORIC ACID HF– SECTION OUTLINE 104 5.9.1 HF ACID OVERVIEW 105 5.9.2 HF 5-YEAR VOLUME FORECAST 106 5.9.3 HF REVENUE FORECAST 107 5.9.4 MAJOR SUPPLIERS OR DISTRIBUTORS OF HF 108 5.9.5 HF REGIONAL SUPPLY 110 5.9.6 HF REGIONAL SUPPLY 111 5.9.7 HF SUPPLY-CHAIN DYNAMICS 112 5.10 NITRIC ACID HNO3– SECTION OUTLINE 113 5.10.1 NITRIC ACID OVERVIEW 114 5.10.2 HNO3 5-YEAR VOLUME FORECAST 115 5.10.3 HNO3 REVENUE 116 5.10.4 NITRIC ACID SUPPLIERS 117 5.10.5 HNO3 SUPPLY CHAIN 118 5.11 ISOPROPANOL IPA– SECTION OUTLINE 119 5.11.1 IPA OVERVIEW 120 5.11.2 ELECTRONIC IPA 5-YEAR VOLUME FORECAST 121 5.11.3 IPA REVENUE FORECAST 122 5.11.4 IPA SUPPLIERS 123 5.11.5 REGIONAL TRENDS 124 5.11.6 SUPPLY CHAIN DYNAMICS 126 5.12 HCL– SECTION OUTLINE 127 5.12.1 HCL OVERVIEW 128 5.12.2 HCL VOLUME FORECAST 129 5.12.3 HCL REVENUE 130 5.12.4 HCL SUPPLIERS 131 5.12.5 REGIONAL TRENDS 132 5.12.6 SUPPLY CHAIN DYNAMICS 133 5.13 NH4OH – SECTION OUTLINE 134 5.13.1 NH4OH OVERVIEW 135 5.13.2 NH4OH VOLUME FORECAST 136 5.13.3 NH4OH REVENUE FORECAST 137 5.13.4 NH4OH SUPPLIERS 138 5.13.5 REGIONAL TRENDS 139 5.13.6 SUPPLY CHAIN DYNAMICS 140 5.14 ESTIMATED SUPPLIER RANKING BY REGION 141 5.15 BASIC WET CHEMICALS ASSESSMENT 142 5.15.1 WET CHEMICALS 143 6 FORMULATED CLEANS 144 6.1 PERRS OVERVIEW – WHAT DO THEY CONSIST OF 145 6.1.2 CU PERR RELATIVE VOLUME GROWTH BY DEVICE 146 6.1.3 AL PERR RELATIVE VOLUME GROWTH BY DEVICE 148 6.1.4 PERR TRENDS - LEGACY VS. LEADING EDGE 150 6.1.5 PERR MARKET SHARE 151 6.1.6 PERR TRENDS - CLEANING COMPLEXITY 152 6.1.7 PERR CHEMISTRY ADDITIVES EXAMPLES 153 6.1.8 PERR MARKET DRIVERS 154 6.2 POST CMP CLEANS PCMP- SECTION OUTLINE 156 6.2.1 PCMP CLEANING 157 6.2.2 PCMP REVENUE FORECAST 158 6.2.3 PCMP CLEANS BY TYPE 159 6.2.4 POST CMP CLEANS BY DEVICE 160 6.2.5 PCMP CLEAN 161 6.2.6 PCMP CLEAN MARKET DYNAMICS 162 6.2.7 GROWTH DRIVERS OF CMP CLEANS 163 6.2.8 PCMP CLEANING TRENDS & CHALLENGES 168 6.2.9 PCMP FUTURE PAST AND PRESENT - MATURE, INNOVATE AND EXPAND PCMP 170 6.2.10 TECHCET ASSESSMENT OF PCMP CLEANING MARKET 171 7 SUMMARY 172 7.1 YEAR 2023 173 7.2 2023 CHEMICAL CMR REPORT OVERVIEW 174 8 APPENDIX 175 8.1 SUPPLY CHAIN - RECYCLE H2SO4 176 8.1.1 SUPPLY CHAIN - SULFURIC ACID PRODUCTION 177 8.2 SUPPLY CHAIN - CHALLENGE OF PRODUCING H3PO4 - PURITY 178 8.2.1 SUPPLY CHAIN - CHALLENGE OF PRODUCING H3PO4 – PURITY, CONTINUED 179 8.3 SUPPLY CHAIN - OLEUM 180 8.4 SUPPLY CHAIN - HF PRODUCTION 181 8.4.1 SUPPLY CHAIN - HF SUB-TIER - AHF PRODUCTION 182 8.4.2 HF / BOE MARKET 183 8.4.3 SUPPLY CHAIN - HF SUB-TIER FLUORSPAR COST COMPONENTS 184 8.5 SUB-TIER SUPPLY CHAIN DEPENDENCIES - IPA PRODUCTION 185 8.5.1 ACETONE IN THE SUPPLY - CHAIN FOR IPA 186 9 SUPPLIER PROFILES 187 ATOTECH AUECC AVANTOR BASF CHANG CHUN PETROCHEMICAL CHEMTRADE ...and 40+ more LIST OF FIGURES FIGURE 1: REVENUE VS YOY % WAFER STARTS AND REVENUE 14 FIGURE 2 TOTAL CHEMICAL REVENUE($ M) 17 FIGURE 3: CHEMICALS BY VOLUME (M KG) 18 FIGURE 4 : GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022) 29 FIGURE 5: WORLDWIDE SEMICONDUCTOR SALES 30 FIGURE 6: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)* 31 FIGURE 7: 2023 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS 32 FIGURE 8: 2022 SEMICONDUCTOR CHIP APPLICATIONS 33 FIGURE 9: MOBILE PHONE SHIPMENTS WW ESTIMATES 34 FIGURE 10: WORLDWIDE PC AND TABLET FORECAST 35 FIGURE 11: ELECTRIFICATION TREND BY WORLD REGION 36 FIGURE 12: SEMICONDUCTOR AUTOMOTIVE PRODUCTION 37 FIGURE 13: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B 39 FIGURE 14: CHIP EXPANSIONS 2022-2027 US $366 B 40 FIGURE 15: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD 42 FIGURE 16: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B) 43 FIGURE 17: OVERVIEW OF ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP 44 FIGURE 18: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM) 45 FIGURE 19: EUROPE CHIP EXPANSION UPSIDE 48 FIGURE 20: PORT OF LA 49 FIGURE 21: TECHCET WAFER START FORECAST BY NODE SEGMENTS** 50 FIGURE 22: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK 51 FIGURE 23: INCREASE IN CLEANING STEPS 60 FIGURE 24: COMPLEXITY OF DEVICE STRUCTURE AND MATERIALS LEAD TO CLEANING COMPLEXITY 61 FIGURE 25: PRICE INDEX FORECAST (WORLD BANK GROUP 2023) 66 FIGURE 26: WACKER RAW MATERIAL PRICING 67 FIGURE 27: TOTAL CHEMICAL REVENUE($ M) 76 FIGURE 28: 2023 CHEMICAL REVENUE ($5.6B) 77 FIGURE 29: 2027 CHEMICAL REVENUE ($7.0 B) 77 FIGURE 30: BASIC CHEMICAL REVENUE ($ M) 78 FIGURE 31: H2SO4 VOLUMES (M KG) 82 FIGURE 32: H2SO4 REVENUES (M $) 83 FIGURE 33: SULFURIC ACID PRODUCER PRICE INDEX US (FRED) 86 FIGURE 34: TSMC CIRCULAR ECONOMY ON SULFURIC ACID 87 FIGURE 35: H2O2 VOLUMES(M KG) 92 FIGURE 36: H2O2 REVENUES (M $) 93 FIGURE 37: H3PO4 VOLUMES M KG 99 FIGURE 38: H3PO4 REVENUE (M $) 100 FIGURE 39: HF VOLUMES (M KG) 106 FIGURE 40: HF REVENUES (M $) 107 FIGURE 41: HNO3 VOLUMES (M KG) 115 FIGURE 42: HNO3 REVENUES (M $) 116 FIGURE 43: IPA VOLUME (M KG) 121 FIGURE 44: IPA REVENUES (M $) 122 FIGURE 45: HCL VOLUMES (M KG) 129 FIGURE 46: HCL REVENUES 130 FIGURE 47: NH4OH VOLUMES (M KG) 136 FIGURE 48: H4OH REVENUES (M $) 137 FIGURE 49: BASIC CHEMICAL REVENUE ($ M) 143 FIGURE 50: CU PERR VOLUME (M KG) 146 FIGURE 51: CU PERR REVENUE 147 FIGURE 52: AL PERR VOLUMES (M KG) 148 FIGURE 53: AL PERR REVENUE 149 FIGURE 54: PERR MARKET SHARE 151 FIGURE 55: COMPLEXITY OF CLEANS 152 FIGURE 56: PCMP CHEMISTRY IN ACTION 156 FIGURE 57: CMP CLEAN REVENUE ($ M) 158 FIGURE 58: TOTAL CLEANS BY SLURRY TYPE. 159 FIGURE 59: CMP CLEANS BY DEVICE 160 FIGURE 60: PCMP CLEAN MARKET SHARE 161 FIGURE 61: SHIFT IN CMP SCOPE 163 FIGURE 62: COMPARISON OF METALS RESISTIVITIES BY DIMENSION 164 FIGURE 63: 14NM VS. 7NM METALLIZATION TECHNIQUES 164 FIGURE 64:DRAM NODE HVM ESTIMATES CMP 165 FIGURE 65: 3D NAND NODE HVM ESTIMATE CMP 166 FIGURE 66: STACKING FOR 3D NAND 167 FIGURE 67: TSMC CIRCULAR ECONOMY ON SULFURIC ACID 176 FIGURE 68: H2SO4 GENERIC PLANT DESIGN 177 FIGURE 69: HF GENERIC PLANT DESIGN 181 FIGURE 70: ALF PRODUCTION COST 184 FIGURE 71: IPA PRODUCTION 185 LIST OF TABLES TABLE 1: GLOBAL GDP AND SEMICONDUCTOR REVENUES* 27 TABLE 2: IMF ECONOMIC OUTLOOK* 28 TABLE 3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022 38 TABLE 4: CHEMICAL EXPANSIONS I 55 TABLE 5: CHEMICAL EXPANSIONS II 56 TABLE 6: CHEMICAL EXPANSIONS III 57 TABLE 7: PRICE TREND HEAT MAP 74 TABLE 8: SULFURIC ACID SUPPLIERS 84 TABLE 9: SULFURIC ACID SUPPLIER ASIA 85 TABLE 10: H2O2 SUPPLIERS 94 TABLE 11: HF SUPPLIERS 108 TABLE 12: HF SUPPLIERS ASIA 109 TABLE 13: IPA SUPPLIERS 123 TABLE 14: IPA US SUPPLY-CHAIN 125 TABLE 15: NH4OH SUPPLIERS 138 TABLE 16: REGIONAL SUPPLIERS EVALUATION 141 TABLE 17: PCMP REVENUE CAGR 158 TABLE 18: SPECIFIC PCMP CLEAN BY TYPE CAGR 159 TABLE 19: PCMP CLEANS BY DEVICE CAGR 160 TABLE 20: PCMP CLEANING CHEMISTRY AND SURFACE COMPATIBILITY 169