Description

This report covers the electronic gas materials market and supply-chain for these materials used in semiconductor device fabrication. One of the challenges that the gas companies encounter is profitability due to the timing of investments and industry downturns for large installations like Air Separation Units (ASUs) and Semiconductor fabs. In the meantime, new suppliers are emerging in the China market to support the “Made in China” program backed by the government. When these suppliers gain in capability and capacity, their influence could dramatically impact the gas supply chain in the next 3+ years

Featured Press Release on Electronic Gases Market Updates and Report Highlights:

Table of Contents:

Click here for a PDF download of the full table of contents

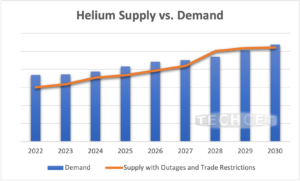

1 EXECUTIVE SUMMARY 13 1.1 ELECTRONIC GAS MARKET – HISTORICAL AND 5-YEAR FORECAST 14 1.2 MARKET DRIVERS FOR THE SPECIALTY GAS MARKET 15 1.2.1 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND 16 1.3 MARKET TRENDS 17 1.4 TECHNOLOGY TRENDS– DEVICE ROADMAP 21 1.4.1 TECHNOLOGY TRENDS – DEVICE SEGMENT OPPORTUNITIES 22 1.5 COMPETITIVE LANDSCAPE– ELECTRONIC GAS MARKET SHARE 23 1.6 SUPPLY CAPACITY AND DEMAND, INVESTMENTS 24 1.7 EHS AND LOGISTIC ISSUES– GREEN HOUSE GASES FROM LOGIC PRODUCTION 25 1.8 MARKET ASSESSMENT SUMMARY 28 2 SCOPE, PURPOSE AND METHODOLOGY 30 2.1 SCOPE 31 2.2 PURPOSE 32 2.3 METHODOLOGY 33 2.4 OVERVIEW OF OTHER TECHCET CMR™ REPORTS 34 3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK 35 3.1 WORLDWIDE ECONOMY 36 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 38 3.1.2 SEMICONDUCTOR SALES GROWTH 39 3.1.3 TAIWAN MONTHLY SALES TRENDS 40 3.1.4 UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023 - SLOWER TO NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED 41 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 42 3.2.1 SMARTPHONES 43 3.2.2 PC UNIT SHIPMENTS 44 3.2.3 SERVERS / IT MARKET 47 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 48 3.3.1 FAB EXPANSION ANNOUNCEMENT SUMMARY 49 3.3.2 WW FAB EXPANSION DRIVING GROWTH 51 3.3.3 EQUIPMENT SPENDING TRENDS 52 3.3.4 TECHNOLOGY ROADMAPS 53 3.3.5 FAB INVESTMENT ASSESSMENT 54 3.4 POLICY & TRADE TRENDS AND IMPACT 55 3.5 SEMICONDUCTOR MATERIALS OVERVIEW 56 3.5.1 COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES? 57 3.5.2 LOGISTICS ISSUES EASED DOWN 58 3.5.3 TECHCET WAFER STARTS FORECAST THROUGH 2027 59 3.5.4 TECHCET’S MATERIAL FORECAST 60 4 ELECTRONIC GASES MARKET TRENDS 61 4.1 MARKET TRENDS DRIVING THE ELECTRONIC GAS BUSINESS 62 4.2 SUPPLY CAPACITY AND DEMAND, INVESTMENTS 64 4.2.1 WF6 DEMAND DRIVERS 67 4.2.2 WF6 MARKET DEMAND 68 4.2.3 WF6 MARKET DEMAND– MO ALD IP FILING 70 4.2.4 WF6 MARKET DEMAND 71 4.3 TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS 72 4.3.1 GENERAL TREND LAST DECADE GOING FROM PVD & LPCVD TO PECVD 73 4.3.2 MARKET TRENDS BY DEVICE TYPE AND NODE – ADVANCED DEVICES 74 4.3.3 MARKET TRENDS– ADVANCED LOGIC 75 4.3.4 MARKET TRENDS– WAFER STARTS DRAM 79 4.3.5 MARKET TRENDS– WAFER STARTS NAND 81 4.3.6 DEPOSITION PROCESS BY DEVICE TYPE AND MATERIAL– AN OVERVIEW 84 4.3.7 ETCH PROCESS BY DEVICE TYPE– ATOMIC LAYER ETCHING ALE 86 4.3.8 SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES 92 4.4 REGIONAL TRENDS 93 4.4.1 REGIONAL TRENDS – LINDE 94 4.4.2 REGIONAL TRENDS– AIR LIQUIDE 95 4.4.3 REGIONAL TRENDS– AIR PRODUCTS 96 4.4.5 REGIONAL TRENDS– TAIYO NIPPON SANO 97 4.4.6 REGIONAL TRENDS– KOREA 98 4.4.7 REGIONAL TRENDS– JAPAN 99 4.4.8 REGIONAL TRENDS– JAPAN & KOREA 100 4.3.15 REGIONAL TRENDS– CHINA 101 4.4.9 REGIONAL TRENDS – RUSSIA 102 4.4.10 REGIONAL TRENDS– USA 103 4.5 GENERAL COMMENTS ON SPECIFICATIONS AND PURITY 106 4.6 ELECTRONIC GAS SUPPLY CHAIN RISK FACTORS 107 4.6.1 GEOPOLITICAL RISKS 108 4.6.2 RUSSIA RISKS 109 4.6.3 SUPPLY CHAIN RISKS– RAW MATERIAL PRICING 110 4.6.4 LOGISTICS 111 4.7 MARKET TRENDS ASSESSMENT 112 5 EHS AND SUSTAINABILITY ISSUES 113 5.1 EHS AND LOGISTIC ISSUES– GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION 114 5.1.2 EHS AND LOGISTIC ISSUES– GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION, CONTINUED 115 5.2 EHS AND LOGISTICS ISSUES 116 5.3 EHS AND LOGISTIC ISSUE – GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION 117 5.4 EHS AND LOGISTIC ISSUES– GREEN HOUSE GASES FROM AIR GASES (NEON) 118 5.4.1 ASU ENERGY CONSUMPTION - GHG EMISSIONS 119 5.4.2 ASU ENERGY CONSUMPTION - GHG EMISSIONS 120 5.4.3 CARBON FOOTPRINT OF SHIFTING NEON SUPPLY FROM UKRAINE TO CHINA 121 5.4.4 CARBON FOOTPRINT OF NEON PRODUCTION 122 5.4.5 CARBON FOOTPRINT OF NEON SHIPPING IN GAS ISO CONTAINER 123 5.4.6 DRAFT CALCULATION TRANSPORT: CHINA VS UKRAINE 124 5.5 SUSTAINABLE SEMICONDUCTOR PROCESSES AND MANUFACTURING TECHNOLOGIES 125 5.6 HELIUM – SUSTAINABLE PRODUCTION – GREEN HELIUM 126 5.7 HELIUM – SUSTAINABLE PRODUCTION – GREEN HELIUM 127 5.8 NF3 REPLACEMENT: F2 GAS 128 5.8.1 FLUORINATED GAS REGULATIONS 129 5.8.2 FLUORINATED GAS REGULATIONS, CONTINUED 130 5.8.3 LINDE F-GAS INSTALLATION 131 5.8.4 ENVIRONMENT REGULATION RISK– IMPLEMENTED TREATIES AND PROTOCOLS 132 6 ELECTRONIC GASES MARKET STATISTICS & FORECASTS 133 6.1 ELECTRONIC GAS MARKET– HISTORICAL AND 5-YEAR FORECAST 134 6.1.1 INDUSTRIAL GAS MARKET 135 6.1.2 ELECTRONIC GAS MA 136 6.1.3 SUPPLIER LIST, FINANCIALS AND PROFILES 137 6.1.4 MARKET DRIVERS FOR THE SPECIALTY GAS MARKET 138 6.2 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND RKET SHARE 139 6.2.1 HE 5-YEAR SUPPLY & DEMAND 140 6.2.1 HE 5-YEAR SUPPLY & DEMAND, CONTINUED 141 6.2.2 NE 5-YEAR SUPPLY & DEMAND 142 6.2.3 NEON 143 6.2.4 XE 5-YEAR SUPPLY & DEMAND 144 6.2.5 NF3 5-YEAR SUPPLY & DEMAND 146 6.2.6 TUNGSTEN HEXAFLUORIDE 5-YEAR SUPPLY & DEMAND 147 6.3 M&A ACTIVITIES 148 6.4 NEW PLANTS 149 6.4.1 NEW PLANTS, LINDE EXPANSIONS 2023 152 6.4.2 NEW PLANTS, AIR LIQUIDE EXPANSIONS 2022/2023 153 6.4.3 NIHON SUO HOLDING CO., LTD. TO INCREASE DIBORANE CAPACITY 154 6.5 SUPPLIER PLANT CLOSURES 155 6.5.1 NEW ENTRANTS– SK MATERIALS, SHOWA DENKO SEEK JOINT ENTRY INTO US SEMICONDUCTOR GAS MARKET 156 6.5.2 NEW ENTRANTS– RESONAC 157 6.5.3 NEW ENTRANTS– NEON, CHINA 158 6.6 PRICING TRENDS 159 6.7 GAS SUPPLY ASSESSMENT 160 7 SUB TIER MATERIAL SUPPLY CHAIN 161 7.1 SALES CHANNELS 162 7.2 LOGISTICS REQUIREMENTS 163 7.2.1 SUB-TIER SUPPLY-CHAIN: TUNGSTEN DISRUPTIONS 164 7.3 SUB-TIER SUPPLY-CHAIN M&A ACTIVITY 166 7.4 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES 167 7.5 SUB-TIER SUPPLY-CHAIN PRICING TRENDS 168 7.6 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT 169 8 SUPPLIER PROFILES 170 ADEKA CORPORATION AIR LIQUIDE AZMAX CO., LTD DNF CO., LTD ENTEGRIS ...and 20+ more 9 APPENDIX 9.1 GASES USED BY MULTIPLE INDUSTRIES 288 9.1.1 SPECIALTY GAS INDUSTRY MATRIX 289 9.1.2 GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING 290 9.1.3 GASES USED IN THE DISPLAY INDUSTRY 291 9.2 SUPPLIER LISTING BY GAS TYPE 294 9.2.1 HYDRIDES 295 9.2.2 SILICON PRECURSORS (SILANES) 296 9.2.3 ETCHANTS/CHAMBER CLEAN 297 9.2.4 DEPOSITION/MISC 298 9.2.5 BULK GASES 299 9.3 ETCH GAS ROADMAPS 300 9.3.1 ETCH ROADMAPS 1 OF 3 301 9.3.2 ETCH ROADMAPS 2 OF 3 302 9.3.3 ETCH ROADMAPS 3 OF 3 303 LIST OF FIGURES FIGURE 1: ELECTRONIC GAS MARKET 14 FIGURE 2: ELECTRONIC GAS MARKET SEGMENTATION 15 FIGURE 3: TECHCET WAFER START FORECAST BY NODE 17 FIGURE 4: TECHNOLOGY ROADMAP DEVICES 21 FIGURE 5: TOTAL ELECTRONIC GAS MARKET SHARE 2021, US$6,3 BILLION 23 FIGURE 6: AIR GAS BOILING POINT 25 FIGURE 7: COMPARISON OF CO2 EMISSIONS FROM VARIOUS TRANSPORTATION MODES 26 FIGURE 8: OCEAN CONTAINER PRICE INDEX - JULY ‘20 TO MARCH ‘23 27 FIGURE 9: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022) 38 FIGURE 10: WORLDWIDE SEMICONDUCTOR SALES 39 FIGURE 11: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)* 40 FIGURE 12: 2023 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS 41 FIGURE 13: 2022 SEMICONDUCTOR CHIP APPLICATIONS 42 FIGURE 14: MOBILE PHONE SHIPMENTS WW ESTIMATES 43 FIGURE 15: WORLDWIDE PC AND TABLET FORECAST 44 FIGURE 16: ELECTRIFICATION TREND BY WORLD REGION 45 FIGURE 17: SEMICONDUCTOR AUTOMOTIVE PRODUCTION 46 FIGURE 18: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B 48 FIGURE 19: CHIP EXPANSIONS 2022-2027 US$366 B 49 FIGURE 20: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD 51 FIGURE 21: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B) 52 FIGURE 22: OVERVIEW OF ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP 53 FIGURE 23: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM) 54 FIGURE 24: EUROPE CHIP EXPANSION UPSIDE 57 FIGURE 25: PORT OF LA 58 FIGURE 26: TECHCET WAFER START FORECAST BY NODE SEGMENTS** 59 FIGURE 27: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK 60 FIGURE 28: 2D PHASE OF BORON AS POSSIBLE FUTURE TRANSISTOR CHANNEL 66 FIGURE 29: 3DNAND MARKET SHARE 2022 67 FIGURE 30: 3DNAND STRUCTURE 68 FIGURE 31: MO PRECURSORS 69 FIGURE 32: PATENT FAMILIES FILED FOR MOLYBDENUM ALD IN THE MEMORY SPACE 70 FIGURE 33:WAFER START FORECAST SHOWING TWO TIMING SCENARIOS WHERE MO COULD BE INTRODUCED (MILLIONS OF 200 MM EQUIVALENT / YEAR) 71 FIGURE 34: 3D DEVICE ARCHITECTURES 73 FIGURE 35: FORECASTS – WAFER STARTS 2021 TO 2027 74 FIGURE 36: FORECASTS – WAFER STARTS LOGIC 300 MM 75 FIGURE 37: SAMSUNG START 3 NM PILOT RAMP USING GAA-FET TECHNOLOGY JUNE 2022 76 FIGURE 38: IMEC 2022 LOGIC ROADMAP 77 FIGURE 39: APPLIED MATERIALS CENTURA PATTERN SHAPING CLUSTER 78 FIGURE 40: FORECASTS – WAFER STARTS DRAM 300 MM 79 FIGURE 41: IP FILING IN THE FIELD OF 3DRAM IS ACCELERATING 80 FIGURE 42: FORECASTS – WAFER STARTS NAND 300 MM 81 FIGURE 43: PATHWAYS FOR CONTINUED 3D NAND SCALING 82 FIGURE 44: 3DNAND SCALING FROM 1 STACK TO 4 STACKS 83 FIGURE 45: SELECTIVE W LOWERS RESISTANCE 85 FIGURE 46: FINFET/GAA TRANSITION 86 FIGURE 47: SELECTIVITY IMPROVEMENT WITH ALE 87 FIGURE 48: ALD AND ALE ROADMAPS OF INTEL, TSMC AND SAMSUNG 88 FIGURE 49: DEP - ALE STI FILL AND RECESS ETCH 90 FIGURE 50: PLASMA AND THERMAL ALE PROCESSES 91 FIGURE 51: AIR LIQUIDE FINANCIALS (ANNUAL REPORT 2022 PENDING) 95 FIGURE 52: KOREA 2021 NEON IMPORTS 98 FIGURE 53: RESONAC BUSINESS SEGMENT REVENUE 2022 99 FIGURE 54: TOTAL HELIUM PRODUCTION 160 MILLION M3 102 FIGURE 55: FLUORSPAR PRICE IN US 2014-2022 110 FIGURE 56: OCEAN CONTAINER PRICE INDEX - JULY ‘20 TO MARCH ‘23 111 FIGURE 57: CO2 EMISSIONS CONTRIBUTIONS WITHIN A CHIP FAB 114 FIGURE 58: GLOBAL WARMING IMPACT FROM VARIOUS PROCESS GASES 115 FIGURE 59: TOTAL EMISSIONS AND ENERGY USE PROJECTION PER LOGIC NODE 116 FIGURE 60: CO2EQ OUTPUT FROM ETCH GASES 117 FIGURE 61: AIR SEPARATION UNIT FLOW CHART 118 FIGURE 62: AIR GAS BOILING POINT 119 FIGURE 63: CARBON GENERATION FROM AIR SEPARATION PROCESSES 120 FIGURE 64: COMPARISON OF CO2 EMISSIONS FROM VARIOUS TRANSPORTATION MODES 123 FIGURE 65: F2 AND NF3 ACTIVATION 128 FIGURE 66: ELECTRONIC GAS MARKET 134 FIGURE 67: TOTAL INDUSTRIAL GAS MARKET 2021, US$97 BILLION 135 FIGURE 68: TOTAL ELECTRONIC GAS MARKET 2021, US$6,3 BILLION 136 FIGURE 69: ELECTRONIC GAS MARKET SEGMENTATION 138 FIGURE 70: HE WW SUPPLY AND DEMAND 140 FIGURE 71: 2027 HELIUM SUPPLY 141 FIGURE 72: TOTAL NEON DEMAND VS. SUPPLY 142 FIGURE 73: KOREA 2021 NEON IMPORTS 143 FIGURE 74: TOTAL XENON DEMAND VS. SUPPLY (MILLION LITERS/YR) 144 FIGURE 75: TOTAL KRYPTON DEMAND VS. SUPPLY (MILLION LITERS/YR) 145 FIGURE 76: NF3 SUPPLY/DEMAND 146 FIGURE 77: AWF6 FORECAST 147 FIGURE 78: HARDMASK SCHEMATIC 154 FIGURE 79: LATEST SITUATION MAP IN UKRAINE, SHOWING TAKEN MAURIUPOL BUT ODESSA STILL FREE 155 FIGURE 80: RESONAC BUSINESS SEGMENT REVENUE 2022 157 FIGURE 81: RARE GAS PRICE ESCALATION 159 FIGURE 65: F2 AND NF3 ACTIVATION 128 FIGURE 66: ELECTRONIC GAS MARKET 134 FIGURE 67: TOTAL INDUSTRIAL GAS MARKET 2021, US$97 BILLION 135 FIGURE 68: TOTAL ELECTRONIC GAS MARKET 2021, US$6,3 BILLION 136 FIGURE 69: ELECTRONIC GAS MARKET SEGMENTATION 138 FIGURE 70: HE WW SUPPLY AND DEMAND 140 FIGURE 71: 2027 HELIUM SUPPLY 141 FIGURE 72: TOTAL NEON DEMAND VS. SUPPLY 142 FIGURE 73: KOREA 2021 NEON IMPORTS 143 FIGURE 74: TOTAL XENON DEMAND VS. SUPPLY (MILLION LITERS/YR) 144 FIGURE 75: TOTAL KRYPTON DEMAND VS. SUPPLY (MILLION LITERS/YR) 145 FIGURE 76: NF3 SUPPLY/DEMAND 146 FIGURE 77: AWF6 FORECAST 147 FIGURE 78: HARDMASK SCHEMATIC 154 FIGURE 79: LATEST SITUATION MAP IN UKRAINE, SHOWING TAKEN MAURIUPOL BUT ODESSA STILL FREE 155 FIGURE 80: RESONAC BUSINESS SEGMENT REVENUE 2022 157 FIGURE 81: RARE GAS PRICE ESCALATION 159 FIGURE 82: HE MATERIALS SUPPLIER TIER STRUCTURE 162 FIGURE 83: TUNGSTEN USE BY INDUSTRY (TECHCET ESTIMATE) 165 FIGURE 84: ELECTRONIC SPECIALTY GASES 177 FIGURE 85: BULK GASES 177 LIST OF TABLES TABLE 1: SPECIALTY AND BULK GAS REVENUE 2022, 2027 14 TABLE 2: ELECTRONIC GAS MARKET GROWTH RATES BY END MARKET 15 TABLE 3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND 16 TABLE 4: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE & PROCESS TECHNOLOGY 22 TABLE 5: GLOBAL GDP AND SEMICONDUCTOR REVENUES* 36 TABLE 6: IMF ECONOMIC OUTLOOK* 37 TABLE 7: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022 47 TABLE 8: OVERVIEW OF DEPOSITION PROCESSES BY DEVICE TYPE AND MATERIAL 84 TABLE 9: ETCH GASES SUMMARY TABLE 91 TABLE 10: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE 92 TABLE 11: LINDE FINANCIALS AND REGIONAL SALES 94 TABLE 12: AIR PRODUCTS REGIONAL FINANCIALS 96 TABLE 13: TAIYO NIPPON SANSO REGIONAL FINANCIALS 97 TABLE 14: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING 104 TABLE 15: REGIONAL SUMMARY OF GAS MARKET 105 TABLE 16: CO2 EMISSIONS PER TONS SHIPPED BY OCEAN, TRUCK OR RAIL 124 TABLE 17: GAS GWP AND ATMOSPHERIC LIFETIME 128 TABLE 18: ELECTRONIC GAS MARKET SIZE AND GROWTH 134 TABLE 19: TOTAL REVENUE 2022 COMPARED TO 2021 OF MAJOR GAS COMPANIES AND GAS SUPPLIERS 137 TABLE 20: ELECTRONIC GAS MARKET GROWTH RATES BY END MARKET 138 TABLE 21: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND 139 TABLE 22: M&A ACTIVITIES 148 TABLE 23: SPECIALTY GAS INDUSTRY MATRIX 173 TABLE 24: GASES USED IN FPD MANUFACTURING 176 TABLE 25: HYDRIDE GAS SUPPLIERS 179 TABLE 26: SILICON PRECURSOR SUPPLIERS 180 TABLE 27: ETCHANT GAS SUPPLIERS 181 TABLE 28: DEPOSITION/MISC. GAS SUPPLIERS 182 TABLE 29: BULK GAS SUPPLIERS 183 TABLE 30: ETCH ROADMAPS 185 TABLE 31: ETCH ROADMAPS 186 TABLE 32: ETCH ROADMAPS 187