Houthi rebel attacks and geopolitical issues raising inflation and energy prices

San Diego, CA, January 23, 2024: TECHCET — the advisory firm providing materials market & supply chain information for the semiconductor industry — reports that healthy recovery is on the way for the Electronic Gases market, following the decline to below US$7 billion in 2023. For the coming year, the Specialty Gas segment is currently forecasted to grow 8% to hit US$5.6 billion, while the Bulk Gas segment will increase by 6% to reach US$1.94 billion. Through the 2022 to 2027 forecast period, the Electronic Gases market will grow at a 6.3% CAGR to top US$9.2 billion, as described in TECHCET’s Critical Materials Report™ on Electronic Gases (https://techcet.com/product/gases/).

“One of the biggest challenges to the gases supply chain has been geopolitics, which has heightened complications within the supply chain due to inflation and high energy prices,” states Jonas Sundqvist, Ph.D., Senior Analyst at TECHCET. Recent geopolitical tensions, including Houthi rebel attacks in the Red Sea and Iran’s activities in the Persian Gulf, have significantly disrupted global shipping routes between Europe and Asia. As Sundqvist notes, these geopolitical challenges compound the existing difficulties in the supply chain, exacerbating inflation and energy price hikes. Due to these tensions, the redirection of shipping routes around the Horn of Africa is driving up shipping costs and extended transit times, impacting the global economy, particularly the supply of consumer goods, gases and chemicals, and energy. The gas market is also dependent on sourcing natural and rare gases from regions of political instability, such as Russia, Ukraine, and the Middle East, which has made it very difficult for suppliers and chip fabricators to come to agreement on long-term or short-term contracts due to potential risk.

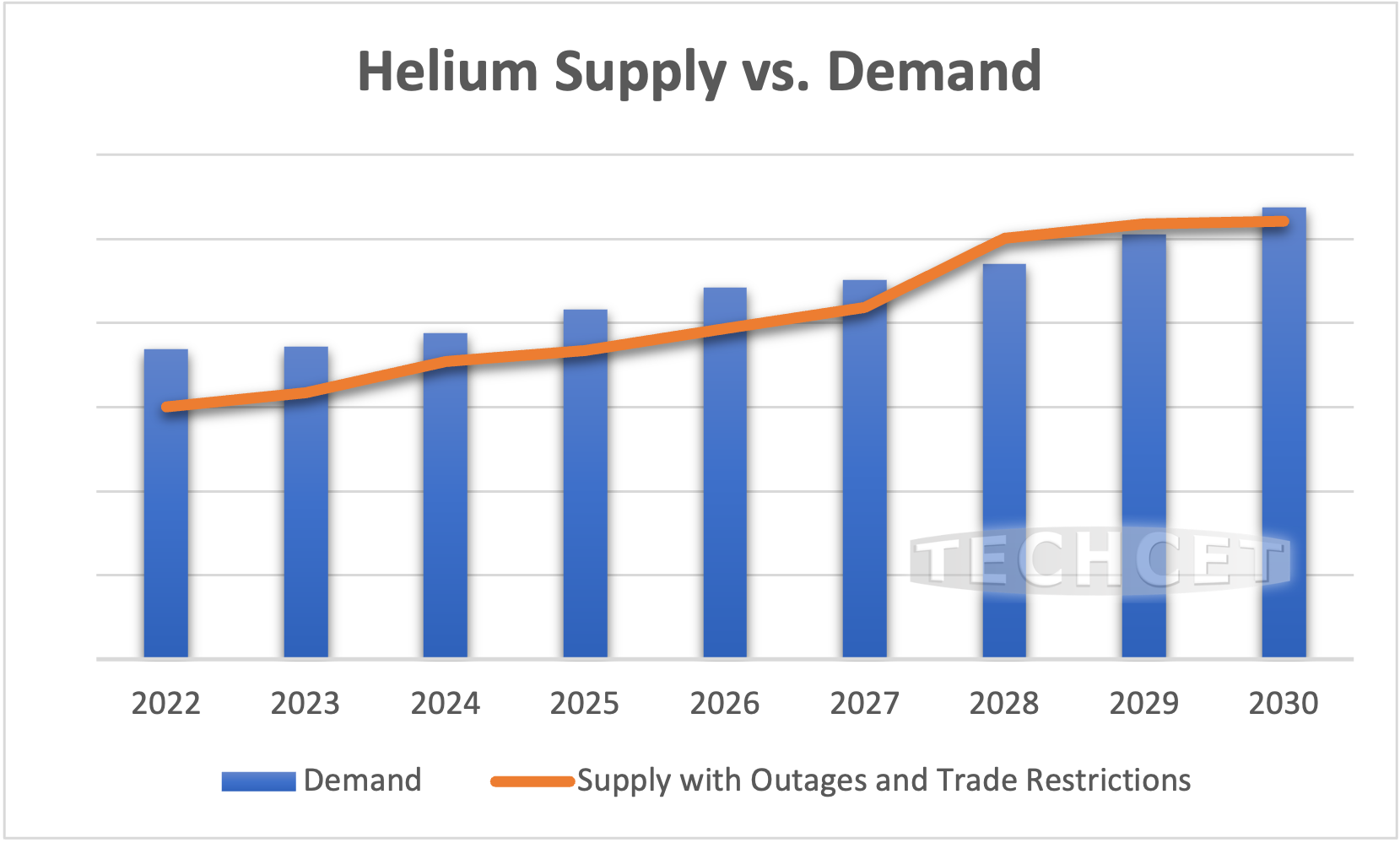

Helium is expected to see steep demand over the next several years from chip manufacturing, one of the fastest-growing segments. TECHCET anticipates helium consumption to grow at an 8% CAGR from 2023 to 2030. Some issues with helium price escalation have come up over the past two years, and global supply is expected to lag demand until 2028, as shown in the graph above.

Additional incremental helium capacity expansions will be required to maintain sufficient supply. If Russian-sourced helium doesn’t come into the market in the next three years, another regional source will have to fill that need, or significant shortages will occur. Europe has diverted its supply from Russia to Algeria and Qatar, which are likely candidates to fill the void for the industry should Russia not be a politically acceptable source of supply. Algeria and Qatar could take the next step to invest in more helium capacity, but they need to justify the cost of increasing natural gas capacity. The risk of relying on Qatar for more helium is that it is located in the Persian Gulf, which could become affected by broader regional conflict.

To purchase or view the full table of contents for TECHCET’s Critical Materials Report™ on Electronic Gases, go to:

https://techcet.com/product/gases/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please email us here, call +1-480-332-8336, or go to www.techcet.com.