Description

This Critical Materials Report™ primarily focuses on the markets of silicon parts used in semiconductor process equipment, including silicon base materials and silicon equipment components for wafer process tools used for semiconductor device manufacturing. These parts are considered consumables, given that they are eventually require replacing after repeated use. Details on the supply-chain from high purity poly-silicon, base material manufacturers, and silicon fabricators are provided.

Featured Press Release on Silicon Parts Market Updates and Report Highlights:

Table of Contents:

Silicon Parts – Click here for a PDF download of the full table of contents

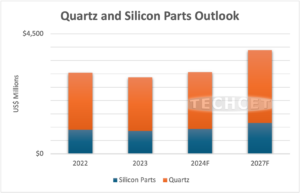

1 SCOPE, PURPOSE, METHODOLOGY 10 1.1 SUPPLY CHAIN & VALUE CHAIN OF SILICON PARTS 11 1.2 OVERVIEW OF OTHER TECHCET CMR™ REPORTS 12 2 EXECUTIVE SUMMARY 13 2.1 OVERVIEW OF THE GLOBAL SEMICONDUCTOR INDUSTRY 14 2.2 OVERVIEW OF THE 2022 SILICON PARTS MARKET 15 2.3 OVERVIEW OF POLYSILICON & SILICON INGOTS 16 2.4 TOP CONCERNS ABOUT SUPPLY AVAILABILITY 17 2.5 SILICON PARTS MARKET ASSESSMENT 18 3 SEMICONDUCTOR INDUSTRY MARKET OUTLOOK 19 3.1 SEMICONDUCTOR MATERIALS OVERVIEW 20 3.2 WORLDWIDE ECONOMY 21 3.2.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY 23 3.2.2 SEMICONDUCTOR SALES GROWTH 24 3.2.3 TAIWAN MONTHLY SALES TRENDS 25 3.3 UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023 – SLOWER TO NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED 26 3.4 CHIPS SALES BY ELECTRONIC GOODS SEGMENT 27 3.4.1 SMARTPHONES 28 3.4.2 PC UNIT SHIPMENTS 29 3.4.3 ELECTRIC VEHICLE (EV) MARKET TRENDS 30 3.4.4 SERVERS / IT MARKET 32 3.5 MATERIALS - WAFER STARTS FORECAST THROUGH 2027 33 3.5.1 TECHCET’S MATERIAL FORECAST 34 4 SILICON PARTS MARKET LANDSCAPE & TRENDS 35 4.1 SI PARTS MARKET SIZE & FORECAST 36 4.2 SILICON - FAB MATERIAL INTRODUCTION & MARKET TREND 37 4.3 SILICON PARTS BY APPLICATION 38 4.4 NON-SEMICONDUCTORAPPLICATIONS SHARING SI PARTS SUPPLY-CHAIN 39 4.5 TECHNOLOGY TRENDS - SILICON PARTS VS. CVD SILICON CARBIDE 40 4.6 SUB-TIER /SILICON INGOT COSTS TRENDS 41 4.7 SILICON FABRICATOR MARKET SHARE BY SUPPLIER 42 4.7.1 SILICON FABRICATOR MARKET SHARE BY SUPPLIER, CONTINUED 43 4.8 REGIONAL TRENDS – TRADE & GEOPOLITICS 44 4.9 REGIONAL TRENDS - TRADE & GEOPOLITICS, CONTINUED 45 4.10 REGIONAL TRENDS – PARTS SUPPLIER MARKET DYNAMICS 46 5 CHIPS FABS GROWTH & CAPITAL EQUIPMENT SPENDING 48 5.1 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION 49 5.1.1 FAB EXPANSION ANNOUNCEMENT SUMMARY 50 5.1.2 WW FAB EXPANSION DRIVING GROWTH 52 5.1.3 FAB EQUIPMENT SPENDING 2019 ~ 2023 53 5.2 EQUIPMENT SPENDING TRENDS 54 5.3 TECHNOLOGY ROADMAPS 55 5.4 FAB INVESTMENT ASSESSMENT 56 5.5 COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES? 57 6 OEM EQUIPMENT MARKET TRENDS 58 6.1 OEM ETCH EQUIPMENT MARKET SHARES ESTIMATE 59 6.2 FABRICATION - SILICON PARTS FABRICATORS BY REGION 60 6.3 TOP 3 OEMS – LAM RESEARCH, TEL, AMAT 61 6.4 OEM ACTIVITIES – LAM RESEARCH AND AMAT 62 6.5 OEM ACTIVITY – LAM RESEARCH 63 6.5.1 OEM ACTIVITY – LAM RESEARCH 64 6.6 TOP 3 OEMS – TEL 65 6.7 OEM ACTIVITIES – AMEC 66 6.8 OEM ACTIVITIES – HITACHI HIGH-TECH 67 6.9 OEM INFLUENCE & CONTROL 68 6.10 POLICY & TRADE TRENDS AND IMPACT 69 7 SUPPLIERS OF INTEREST 70 7.1 SILICON PARTS PRODUCTION PERFORMANCE, 71 7.2 SUPPLIERS ACTIVITY - M&A ACTIVITY 72 7.3 SUPPLIERS ACTIVITY - NEW PLANTS/NEW INVESTMENTS 73 7.4 GLOBAL TRENDS - SIFUSION FROM CHINA (FERROTEC) 74 7.5 GLOBAL TRENDS – SPOTLIGHT ON GRITEK 75 7.6 GLOBAL TRENDS – SPOTLIGHT ON MITSUBISHI MATERIALS 76 7.7 NEW SUPPLIER ENTERING THE MARKET: LATTICE MATERIALS 77 7.8 NEW SUPPLIER ENTERING THE MARKET: SHANGHAI SYC 78 7.9 NEW SUPPLIER ENTERING THE MARKET: API 79 8 SUB-TIER SUPPLY: SILICON INGOT GROWERS 80 8.1 BASE MATERIAL - SILICON INGOT MANUFACTURERS/SUPPLIERS 81 8.1.1 SINO AMERICAN SILICON – SAS 82 8.1.2 THINKON SEMI 83 8.2 CHINA SILICON INGOT MANUFACTURER – THINKON SEMI UPDATE 84 9 POLYSILICON 85 9.1 RAW MATERIAL SOURCE AND STATUS - POLYSILICON 86 9.2 RAW MATERIAL SOURCE AND STATUS - POLYSILICON DEMAND 87 9.3 SEMICONDUCTOR-GRADE POLYSILICON SUPPLIERS 88 9.4 POLYSILICON - RAW MATERIAL HISTORICAL PRICES 2023 89 9.5 RAW MATERIAL SOURCE AND STATUS - POLYSILICON, ASSESSMENT 90 9.6 BASE MATERIAL – SILICON SUPPLIERS USING POLYSILICON 91 10 SUB-TIER MATERIAL SUPPLY CHAIN 92 10.1 SUPPLY CHAIN DISRUPTIONS/CONSTRAINTS 93 10.2 SUPPLY CHAIN DISRUPTIONS/CONSTRAINTS, CONTINUED 94 10.3 OTHER INDUSTRIAL USES 95 10.4 SILICON PARTS PRODUCTION LOCATION - ANALYSIS 96 11 TECHCET ANALYST ASSESSMENT 97 11.1 TECHCET ANALYST ASSESSMENT 98 11.2 TECHCET ANALYST ASSESSMENT, CONTINUED 99 11.3 TECHCET ANALYST ASSESSMENT, CONTINUED 100 11.4 MATERIALS MARKET LANDSCAPE TRENDS 101 12 SUPPLIER PROFILES 102 Addison Engineering Alliance Precision/API Applied Ceramics BCnC Co., Ltd. Bullen Ultrasonics ...and 20+ more FIGURES FIGURE 1: 2022 SILICON FABRICATED PARTS REVENUES AND FORECAST ESTIMATES (M USD) 15 FIGURE 2: SILICON INGOT 16 FIGURE 3: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022) 23 FIGURE 4: WORLDWIDE SEMICONDUCTOR SALES 24 FIGURE 5: TECHCET’S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)* 25 FIGURE 6: 2023 SEMICONDUCTOR REVENUE OUTLOOK 26 FIGURE 7: 2022 SEMICONDUCTOR CHIP APPLICATIONS 27 FIGURE 8: MOBILE PHONE SHIPMENTS WW ESTIMATES 28 FIGURE 9: WORLDWIDE PC AND TABLET FORECAST 29 FIGURE 10: ELECTRIFICATION TREND BY WORLD REGION 30 FIGURE 11: SEMICONDUCTOR AUTOMOTIVE PRODUCTION 31 FIGURE 12: TECHCET WAFER START FORECAST BY NODE SEGMENTS** 33 FIGURE 13: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK 34 FIGURE 14: SILICON PARTS FROM SILFEX 35 FIGURE 15: 2022 SILICON FABRICATED PARTS REVENUES AND FORECAST ESTIMATES (M USD) 36 FIGURE 16: 2021 SILICON PARTS BY WAFER SIZE 38 FIGURE 17: 2022 SILICON PARTS BY WAFER SIZE 38 FIGURE 18: 2023 AR/VR SHIPMENT (1,000 UNITS) 39 FIGURE 19: 2022 SILICON FABRICATOR MARKET SHARE BY SUPPLIER 42 FIGURE 20: 2022 SILICON PARTS CONSUMPTION BY END USE LOCATION ESTIMATE 48 FIGURE 21: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B 49 FIGURE 22: CHIP EXPANSIONS 2022-2027 US $473.6B 50 FIGURE 23: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD 52 FIGURE 24: FAB EQUIPMENT SPENDING 53 FIGURE 25: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B) 54 FIGURE 26: OVERVIEW OF ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP 55 FIGURE 27: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING 56 FIGURE 28: EUROPE CHIP EXPANSION UPSIDE 57 FIGURE 29: 2022 ETCH EQUIPMENT MARKET SHARE 59 FIGURE 30: 2022 SILICON PARTS CONSUMPTION BY END USE LOCATION ESTIMATE 60 FIGURE 31: 2022 LAM RESEARCH VS. APPLIED MATERIALS BUSINESS SEGMENT REVENUES (M USD) 62 FIGURE 32: LAM RESEARCH FACILITIES 63 FIGURE 33: SK ENPULSE’S PLANTS IN KOREA 72 FIGURE 34: SIFUSION FERROTEC LOCATION IN CHINA 73 FIGURE 35: SIFUSION HANGZHOU FACTORY 74 FIGURE 36: GRITEK MANUFACTURING LOCATION INSIDE 75 FIGURE 37: MITSUBISHI MATERIALS SANDA PLANT 76 FIGURE 38: SYC HEADQUARTER IN SHANGHAI 78 FIGURE 39: OPERATION CEREMONY OF API IN 2019 79 FIGURE 40: SAS 82 FIGURE 41: THINKONSEMI HQ IN JINZHOU, CHINA 83 FIGURE 42: THINKONSEMI 550MM SILICON WAFER (2020) 84 FIGURE 43: POLYSILICON DEMAND FORECAST FOR SEMICONDUCTOR WAFERS 87 FIGURE 44: 2023 AVERAGE POLYSILICON SPOT MARKET PRICE ($/KG) 89 FIGURE 45: 2014-2023 AVERAGE POLYSILICON SPOT MARKET PRICE ($/KG) 90 FIGURE 46: YOY POLYSILICON (KG) CONSUMPTION ESTIMATES 91 FIGURE 47: MONOCRYSTALLINE SILICON AND POLYSILICON SOLAR PANELS 95 FIGURE 48: US EXCHANGE RATE TRENDS 1/2020 TO 8/2022 (EU, TWD, RMB, KRW, JPY) 96 TABLES TABLE 1: GLOBAL GDP AND SEMICONDUCTOR REVENUES* 21 TABLE 2: IMF ECONOMIC OUTLOOK* 22 TABLE 3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022 32 TABLE 4: 2022 SILICON FABRICATOR MARKET SHARE BY SUPPLIER 43 TABLE 5: 2022 OEM SYSTEM PUBLICLY REPORTED SALES BY REGION 61 TABLE 6: TEL REVENUES BY END USER 65 TABLE 7: LEADING SILICON PARTS FABRICATION REVENUES 71 TABLE 8: SI PARTS SUPPLIERS THAT SELL SILICON INGOT FOR SILICON PARTS FABRICATION 81 TABLE 9: SEMICONDUCTOR – GRADE POLYSILICON SUPPLIERS 88 TABLE 10: SILICON MATERIAL AND PARTS FABRICATOR LISTING 103