Description

This report aims to provide an overview of the quartz material and parts supply chain, serving the semiconductor industry. This information about this critical material is essential in the running of the semiconductor wafer fabs across the world. The goal is to annually track the state of the industry; the health of the supply and demand; to pinpoint any shortcomings or issues faced by the industry; and to provide a guidance for purchasing and industry quality improvement decisions. We hope to provide a dialog and feedback opportunities for related stakeholders to fine-tune and better manage the supply ups and downs. The report contains data and analysis from TECHCET’s database and Sr. Analyst experience, as well as that developed from primary and secondary market research.

Featured Press Release on Quartz Market Updates and Report Highlights:

Table of Contents:

Click here for a PDF download of the full table of contents

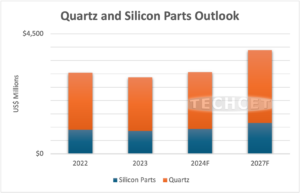

1 EXECUTIVE SUMMARY 8 1.1 Highlight Material Segment Business Overview 8 1.2 Highlight Material Segment Market Trends 9 1.3 Highlight Material Segment Technology Trends 9 1.3.1 5-Year Material Forecast 9 1.4 Competitive Landscape 10 1.5 EHS Issues/Concerns 11 1.6 Analyst Assessment 11 1.6.1 Base Materials 11 1.6.2 High-Purity Quartz Powder 12 2 SCOPE, PURPOSE AND METHODOLOGY 13 2.1 Scope 13 2.2 Purpose 13 2.3 Methodology 13 2.4 Overview of Other TECHCET CMR™ Reports 14 3 MARKET OUTLOOK 15 3.1 Semiconductor Industry Market Status & Outlook 15 3.2 Global Economy 15 3.2.1 Semiconductor Industries Ties to the Global Economy 17 3.2.2 Semiconductor Sales Growth 17 3.2.3 Taiwan Monthly Sales Trends 18 3.2.4 2023 /Semiconductor Industry Outlook 19 3.3 Electronic Goods Market 20 3.3.1 Electronic Goods Market 20 3.3.2 Automotive Sales 22 3.4 Semiconductor Fabrication Growth & Expansion 24 3.4.1 Fab Expansion Announcement Summary 24 3.4.2 Worldwide Fab Expansion Driving Growth 25 3.4.3 Equipment Spending Trends 26 3.4.4 Technology Roadmaps 27 3.4.5 Policy and Trade Issues 28 3.5 Semiconductor Materials Outlook 28 3.5.1 Could Materials Capacity Limit Chip Production Schedules 29 3.5.2 Continued Logistics Issues Plague the Western World 29 3.5.3 Wafer Start Growth and Materials 29 3.5.4 Materials Forecast 31 4 MATERIAL MARKET DRIVERS & DYNAMICS 33 4.1 Quartz Material Applications and Suppliers 33 4.1.2 Thermal Processes 35 4.1.3 Dry Etching Process 35 4.1.4 Plasma CVD 36 4.1.5 Epitaxial Process 36 4.1.6 Lithography Process 37 4.2 Impact of Silicon Wafer Size Issues on Fabricated Parts 37 4.3 Material Shortages and Supply Chain Constraints 38 4.4 Technical Drivers / Material Changes and Transitions 39 4.4.1 Material Trends for the Leading-Edge 40 4.4.2 Trends/Impact/Status of Legacy Materials (200 mm & 150 mm) 41 4.5 Comment on Regional Trends/Drivers 41 4.6 EHS, Logistic, AND Exogenous (Weather) Market Issues 42 5 Quartz Supplier Market Landscape 44 5.1 M&A Activity 44 5.2 Expansions or New Plants of Existing Suppliers 44 5.3 Suppliers or Parts/Product Line That Are at Risk of Discontinuation 45 5.4 Pricing Trends 45 5.5 Market Size and Forecast 45 5.6 Quartz Fabrication Market Shares 47 5.7 Supply Chain and Innovations 52 5.8 Quartz Fabrication by Process Segment 54 5.9 Quartz Fabrication Market Leadership By Region 56 6 SUB TIER MATERIAL SUPPLY CHAIN 58 6.1 Sub-Tier, Quartz Base Materials 58 6.2 Quartz Powder 63 6.3 Other Industrial Uses for Quartz Base Material 64 6.4 Raw Supply Chain Disruptions and Logistics Issues 64 6.5 M&A Activity 64 6.6 Raw Material EHS Issues 64 6.7 New Entrants 65 6.8 New Plants or Expansions 65 6.9 Plant Closures 65 6.10 Products at risk of discontinuation 65 6.11 Raw Material Pricing Trends 65 7 SUPPLIER PROFILES (FABRICATORS) 66 Applied Ceramics, Inc. Beijing Kaide Quartz Co., Ltd. Tosoh Quartz DS Techno Co., Ltd. FerroTec Holdings Corporation Maruwa ...and 20+ more TABLE OF FIGURES Figure 1: Fabricated Quartz Components Market Share by Supplier 10 Figure 2: 2022 Quartz Base Materials Market Share by Supplier 12 Figure 3: Global Economy and the Electronics Supply Chain (2022) 17 Figure 4: Worldwide Semiconductor Sales 18 Figure 5: Monthly Sales Trends of Taiwan Outsource Manufacturers 19 Figure 6: 2023 Semiconductor Revenue Outlook 19 Figure 7: 2022 Semiconductor Chip Applications 20 Figure 8: Mobile Phone Shipments WW Estimates 21 Figure 9: Worldwide PC and Tablet Forecast, 2021, Q3 21 Figure 10: Electrification Trend by World Region 22 Figure 11: Semiconductor Spend per Vehicle Type 23 Figure 12: Chip Expansions 2022-2027, about US$336 B 24 Figure 13: US Chip Fab Expansions 25 Figure 14: Semiconductor Chip Manufacturing Regions of the World 26 Figure 15: Global Total Equipment Spending by Segment (USD B 27 Figure 16: Europe Chip Expansion Upside 29 Figure 17: TECHCET Wafer Start Forecast by Node 30 Figure 18: TECHCET Wafer Start Forecast for < 45 nm and below Logic 31 Figure 19: Global Semiconductor Materials Outlook 32 Figure 20: Quartz Products for Semiconductor Applications 34 Figure 21: Quartz Products for Semiconductor Applications 35 Figure 22: Fabricated Quartz Components for Dry Etching Process 36 Figure 23: Fabricated Quartz Components for Batch Epitaxial Process 37 Figure 24: Fabricated Quartz Revenue History and Forecast 46 Figure 25: 2022 Total Fabricated Quartz Components Market by Supplier 48 Figure 26: 2022 Cold Work (SW) Fabrication Market Share (as a % of Total Revenues) 49 Figure 27: 2022 Hot Work (Batch) Fabrication Market Share (as a % of Revenues) 50 Figure 28: Wafer Fabrication Equipment Revenues of Leading Etch and Deposition Companies 55 Figure 29: Estimated 2022 Quartzware Market Size by Region 57 Figure 30: Base Materials Revenue History and Forecast 59 Figure 31: Total 2022 Quartz Base Materials Market Share by Supplier 60 Figure 32: 2022 Ingot Market Share 62 Figure 33: 2022 Rod/Tube Market Share 62 Figure 34: Quartz Powder Market Share 63 TABLES Table 1: 2023 TECHCET Critical Material Reports 14 Table 2: Global GDP and Semiconductor Revenues 15 Table 3: IMF World Economic Outlook 16 Table 4: Data Center Systems and Communication Services Forecast 2023 23 Table 5: Quartz Size and Weight Increase from 200mm to 300mm Thermal Process 38 Table 6: Summary of Key Fabricators Expansion Projects 44 Table 7: Total Fabricated Quartz Components Revenue History and Forecast* 46 Table 8: Which Quartz Fabricators Supply to OEM or IDMs? 53 Table 9: Quartz Fabricator Market Ranking by Region 2022 56 Table 10: Total Base Materials Revenue History and Forecast 58