Description

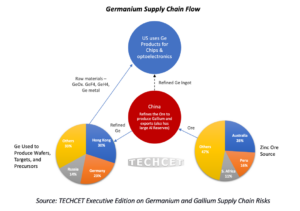

This TECHCET Executive Edition provides information on the dependencies of the Semiconductor industry on the Germanium and Gallium Supply Chains, especially as they relate to the US. Information is provided on the sources of these key materials, in what form they are used for semiconductor production, the importance of their use, and China vs. US mining and mineral production capacity. An assessment of the overall supply risk to the Western world is also provided.

Featured Press Release on Ge/Ga Supply Chain Report Highlights:

TABLE OF CONTENTS

Click here for a PDF download of the full table of contents

1 SCOPE 6 2 EXECUTIVE SUMMARY 6 3 GERMANIUM 8 3.1 GERMANIUM OVERVIEW – WHY IS IT IMPORTANT? 8 3.2 GERMANIUM - WHAT KINDS OF SEMICONDUCTOR IS IT USED FOR? 8 3.3 GERMANIUM - WHERE DOES IT COME FROM? 9 3.4 HOW IS IT MADE? FROM ORE TO END USE PRODUCT 10 3.4.1 Leading North American Sources of Germanium: 10 3.4.2 How is GeH4 made? 11 3.5 SUPPLIERS OF GE END USE PRODUCTS TO THE SEMICONDUCTOR INDUSTRY 13 3.5.1 US GeH4 Producers 13 3.5.2 Germanium Sputter Targets and Substrates 14 3.5.3 Tracing the GeH4 Supply Chain 14 3.6 GERMANIUM US IMPORTS - ORIGINATING LOCATION AND MIX 16 3.7 GERMANIUM - BUILDING NEW US CAPACITY 17 3.8 GERMANIUM – WHO USES IT? SEMICONDUCTOR DEVICE MANUFACTURERS 17 3.9 GERMANIUM RAW MATERIAL PRICE TRENDS 18 4 GALLIUM 20 4.1 GALLIUM OVERVIEW – WHY IS IT IMPORTANT? 20 4.2 GALLIUM – WHAT KIND OF ELECTRONIC DEVICES IS IT USED FOR? 20 4.3 GALLIUM WHERE DOES GALLIUM COME FROM? 21 4.4 HOW IS IT MADE? FROM ORE TO END USE PRODUCT 22 4.5 SUPPLIERS OF GA END USE PRODUCTS TO THE SEMICONDUCTOR INDUSTRY 24 4.5.1 Tracking the Gallium Supply Chain 25 4.6 GALLIUM US IMPORTS - ORIGINATING LOCATION AND MIX 27 4.7 GALLIUM - BUILDING NEW US CAPACITY 28 4.8 GALLIUM – WHO USES IT? SEMICONDUCTOR DEVICE MANUFACTURERS 28 4.9 GALLIUM RAW MATERIAL PRICE TRENDS 29 5 CHINA GA & GE TRADE RESTRICTIONS 31 6 GALLIUM AND GERMANIUM GEOPOLITICAL RISKS & ASSESSMENT 32 7 REFERENCES 34 FIGURES FIGURE 1: GERMANIUM AND GALLIUM PRODUCTION BY REGION ESTIMATES 7 FIGURE 2: US GERMANIUM USE APPLICATIONS ESTIMATE (AS A PERCENT OF TOTAL WEIGHT) 2022 8 FIGURE 3: SILICON-GERMANIUM (SIGE) IS CRUCIAL IN 2 NM GAA-FET FABRICATION 9 FIGURE 4: 2021 GERMANIUM PRODUCTION ESTIMATES AS A PERCENTAGE OF TOTAL OUTPUT (TONS) 10 FIGURE 5: GEO2 AND GECL4 PRODUCTION FROM GE CONCENTRATE 12 FIGURE 6: AIR LIQUIDE (VOLTAIX) GERMANE PLANT IN BRANCHBURG, NJ (USA) 14 FIGURE 7: GERMANIUM ORE TO FINISHED PRODUCTS INTO THE US – SUPPLY CHAIN FLOW 15 FIGURE 8: GERMANIUM US IMPORTS BY COUNTRY OF ORIGIN 17 FIGURE 9: SEMICONDUCTOR DEVICE MANUFACTURERS USING SIGE TECHNOLOGY BY REGION (AS A PERCENT OF 200MM EQUIVALENT CAPACITY*) 18 FIGURE 10: GERMANIUM PRICE TRENDS 2018 TO 2023 19 FIGURE 11: GERMANIUM METAL SHANGHAI METAL MARKET FUTURES (PRICES PER KG) 19 FIGURE 12: CHINA WROUGHT AND UNWROUGHT GERMANIUM EXPORT FOR JAN – AUG 2023 20 FIGURE 13: WORLD GALLIUM PRODUCTION AS A PERCENT OF TOTAL VOLUME (METRIC TONS) 22 FIGURE 14: GALLIUM PRECURSOR SUPPLY CHAIN 23 FIGURE 15: EXAMPLE OF MOLECULAR BEAM EPITAXY SYSTEM 24 FIGURE 16: GALLIUM ORE TO FINISHED PRODUCTS INTO THE US – SUPPLY CHAIN FLOW 26 FIGURE 17: US GALLIUM IMPORTS SHOWING COUNTRY DEPENDENCY 28 FIGURE 18: : SEMICONDUCTOR DEVICE & LED MANUFACTURERS USING GAAS/GAN/GAP BY REGION 29 FIGURE 19: GALLIUM METAL PRICE TRENDS 2018-2023 30 FIGURE 20: GALLIUM METAL SHANGHAI METAL MARKET FUTURES (PRICES PER KG) 30 FIGURE 21: CHINA WROUGHT AND UNWROUGHT GA EXPORTS 2023 31 TABLES TABLE 1: ELECTRONIC DEVICES AND THEIR USE OF GERMANIUM 9 TABLE 2: GERMANIUM SEMICONDUCTOR VALUE CHAIN 16 TABLE 3: MOST POPULAR APPLICATIONS FOR GALLIUM SUBSTRATES INCLUDE GAAS AND GAN COMPOUND 21 TABLE 4: GA-CONTAINING SEMICONDUCTOR PROCESS MATERIALS SUPPLIERS AND LOCATIONS 25 TABLE 5: GALLIUM SEMICONDUCTOR VALUE CHAIN 27