Restructured Supply Chain Responding with Investment Plans

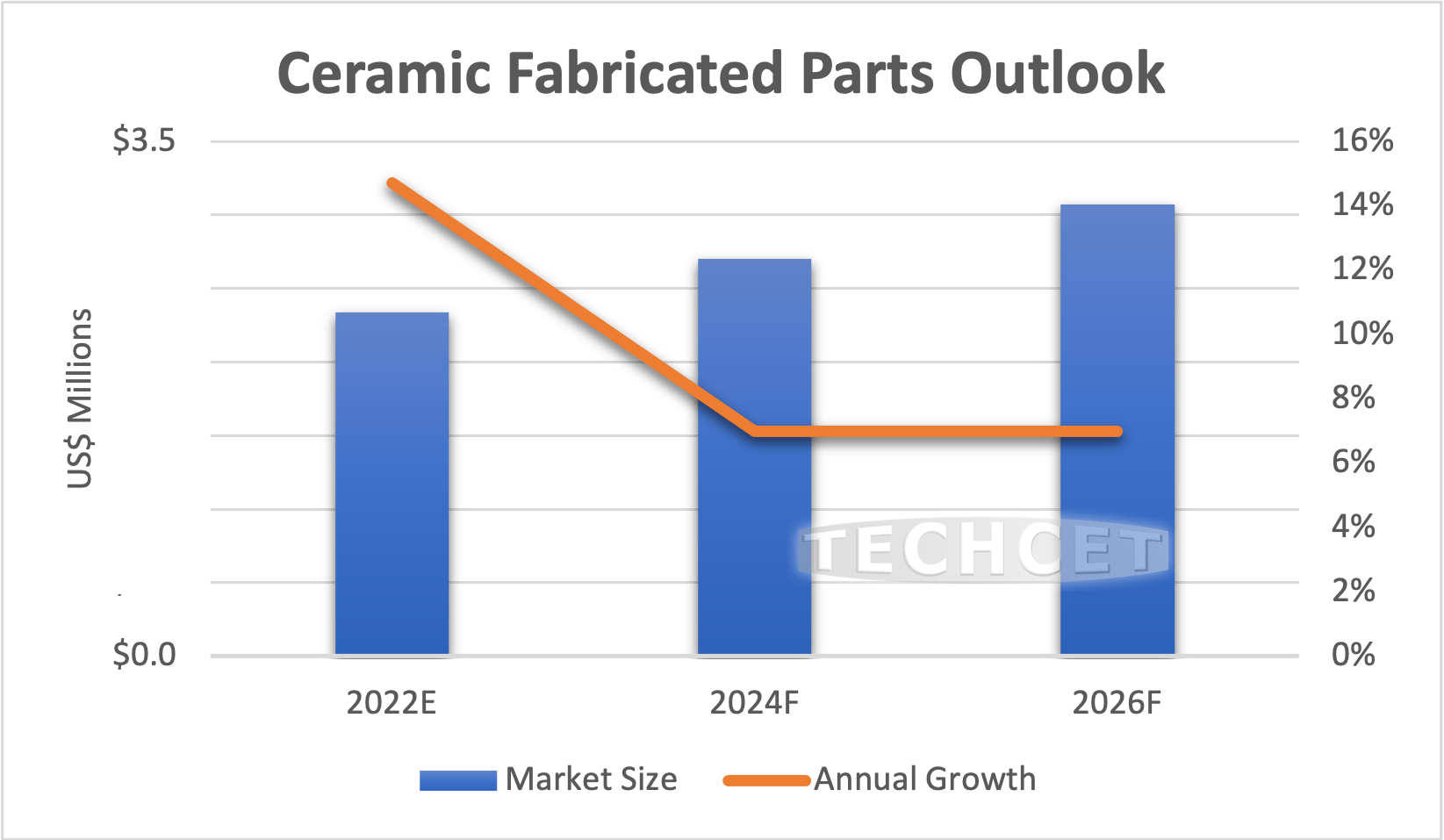

San Diego, CA, October 18, 2022: TECHCET—the electronic materials advisory firm providing business and technology information— recently announced that the Ceramic Fabricated Parts market for semiconductor fabrication equipment consumables is expected to reach US$2.3 billion in 2022, a 15% jump from US$2.0 billion in 2021. The fabricated ceramic components market is strongly affected by the semiconductor production and demand for wafer fabrication equipment, as highlighted in TECHCET’s new Ceramics CMR™ Market Report. The segment includes alumina, aluminum nitride, SiC, and other ceramic materials (e.g., Yttria coated ceramics) used in thermal processing, etch, epitaxial, and other semiconductor process equipment.

“Market demand from existing installed equipment in semiconductor fabs and the demand for new processing equipment grew significantly as the equipment market heated back in 2020,” states Karey Holland, PhD., senior analyst at TECHCET. Since then, demand has been sustained through the first half of 2022. Recently, there have been some slight signs of weakness in the memory market, though the ceramic parts market should continue growing into 2023 as current equipment orders get delivered. In the longer term, all the planned fab expansions and new fab investments will drive >8% CAGR through the 2026 forecast period.

Demand for replacement parts is largely supported by spares sold by local suppliers. New equipment OEM sales during an upturn strongly favor parts from suppliers with exclusive agreements with OEMs. There are indications of some price increases over the past years as fabs increased consumption of consumable parts and OEM increased production, resulting in a strain on supply capacity. As such, ceramic parts are sourced from different areas of the world to maximize efficiency and minimize turn-around time. This is possible because many of the leading parts fabricators have multiple locations for manufacturing.

For parts suppliers adding manufacturing capacity, there are some challenges facing the supply chain. For one, it usually takes a year to build a new ceramic fabrication factory and half a year to source the CNC equipment. There is currently 15% price increase for CNC systems, and companies expect delays in shipping CNCs. Additionally, kilns for sintering ceramic components now have lead times of 12 to 15 months. Therefore, a typical ceramic fabrication plant expansion can take up to 2-2.5 years to plan and implement. It takes even longer planning for setting up a high purity ceramic powder production. Historical downturns have caught suppliers by surprise, making them cautious when it comes to new investments, and now part suppliers are cautious about possible changes affecting the 2023 outlook.

For more details on the Ceramic Fabricated Parts Material market segments and growth, including profiles on suppliers like ADMAP Inc, Applied Ceramics, Ariake Material Company, Asahi Glass Company, Ltd., Asuzac, and more, visit

https://techcet.com/product/ceramics/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market analysis and business development of electronic markets and supply-chains for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, reports, and subscription services, including the Critical Materials Council (CMC) of semiconductor fabricators and CM Data subscription services. For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.