Critical gases like B2H6 and WF6 may face supply constraints

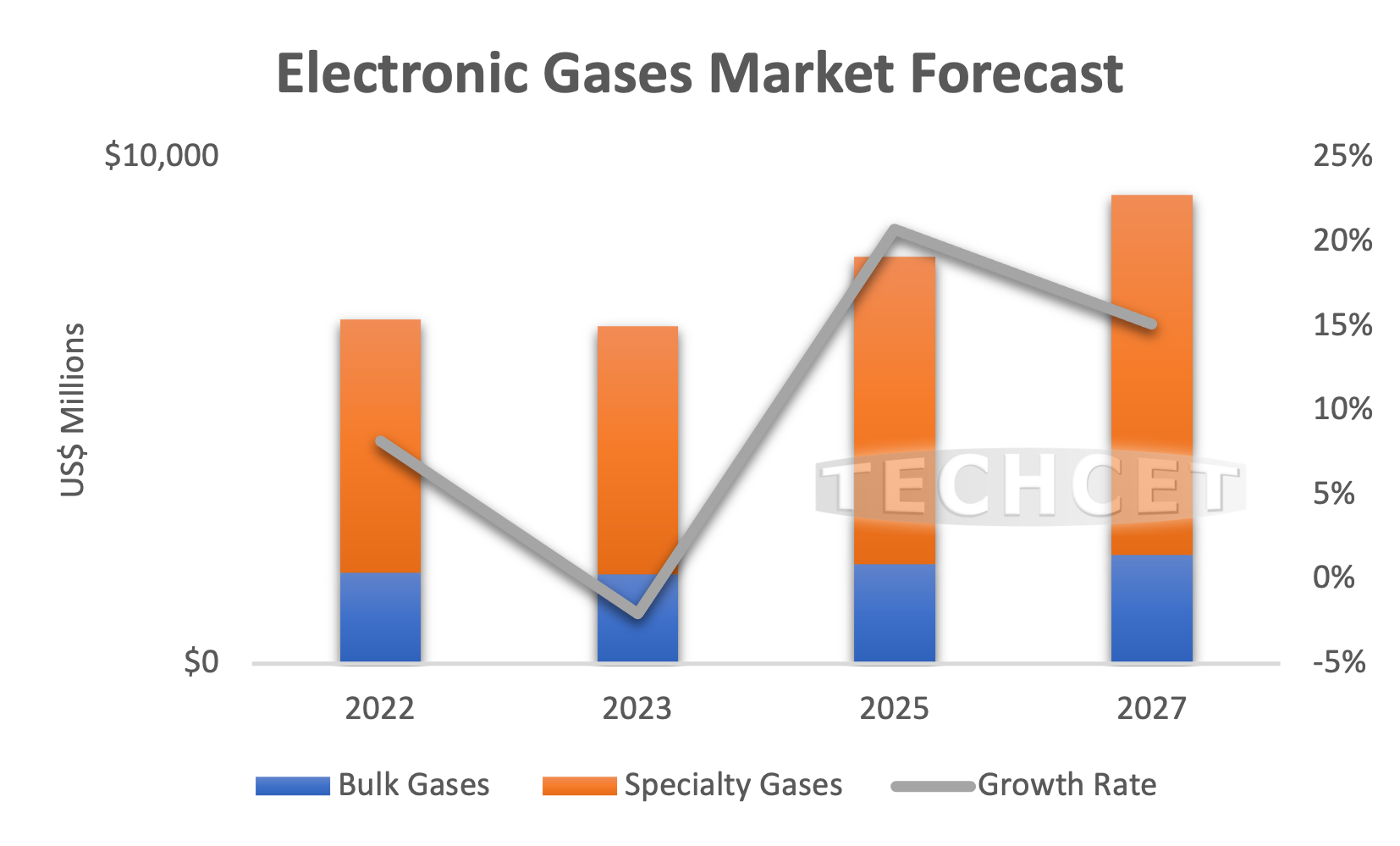

San Diego, CA, June 1, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting an upward 5-year CAGR of 6.4% for the electronic gas market, as indicated in the newly released Electronic Gases Critical Materials Report™. This positive forecast in electronic gases is primarily due to expansions within the semiconductor industry, with leading-edge logic and 3DNAND applications being the most impactful to growth. As ongoing fab expansions come online in the next few years, additional supply of gases will be necessary to accommodate demand, hence upping market performance for gases. In the US, there are currently six major chipmakers planning to build new fabs: GlobalFoundries, Intel, Samsung, TSMC, Texas Instruments, and Micron Technology.

.

.Supply constraints for electronic gases may appear as demand increases are expected to outpace supply. For example, diborane (B2H6) and tungsten hexafluoride (WF6) are both critical for manufacturing various types of semiconductor devices such as logic IC, DRAM, 3DNAND memory, flash memory, and more. Because of their critical role, they are expected to see rapid demand increase as fabs ramp up. Some Asian suppliers are now taking the opportunity to fill these supply gaps within the US market.

Disruptions in gas supply from current sources have also heightened the need to bring new gas suppliers into the market. Ukrainian suppliers of crude neon, for example, are currently no longer functional due to the Russia War, and may be out permanently. This has placed a severe constraint on the neon supply chain that will not be alleviated until new supply sources comes online in other regions.

“Helium supply is also at high risk. The US BLM transferring ownership of helium stores and equipment may interrupt supply as equipment may need to be taken offline for maintenance and upgrades,” states Jonas Sundqvist, Senior Analyst at TECHCET. Unfortunately, there has been little to no new helium capacity built over the past year, with the exception of Russia, to make up for future demand growth and any supply chain disruptions. Russia’s capacity continues to be questionable given the war. Additionally, TECHCET is currently anticipating potential shortages for Xe, Kr, NF3, and WF6 over the next few years unless additional capacity is brought on line.

For more details on the Electronic Gases market segment and growth trajectory, including profiles on suppliers like Adeka, Air Liquide, Entegris, Linde, TNSC, and more, go to: https://techcet.com/product/gases/

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact info@cmcfabs.org, +1-480-332-8336, or go to www.techcet.com.