Domestic chemical demand to leap through 2027, though supply is not prepared

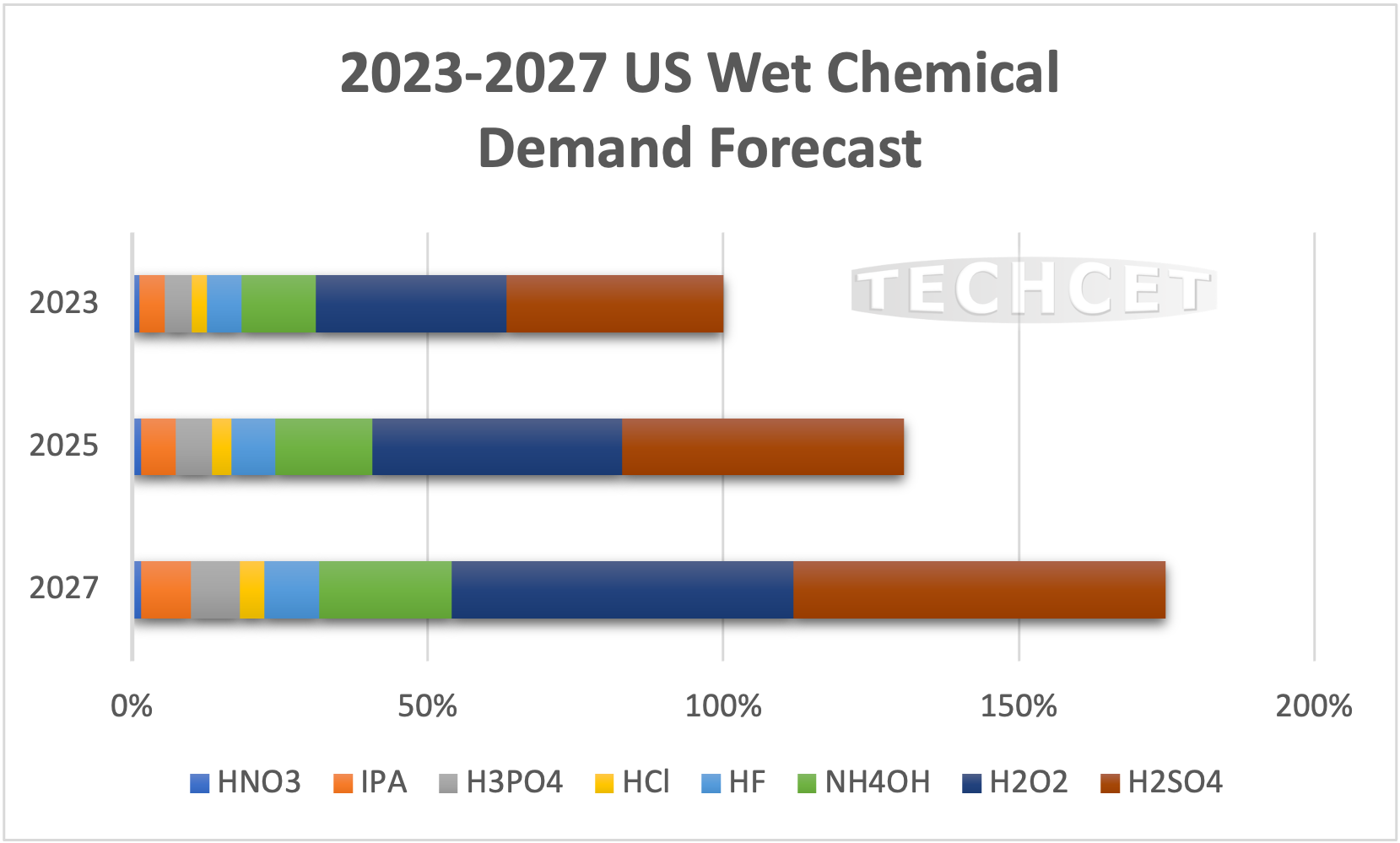

San Diego, CA, October 31, 2023: TECHCET — the electronic materials advisory firm providing market and supply-chain information — is forecasting US demand for the bulk chemical sector to increase by a combined 75% by 2027. The anticipated demand jump is due to announced fab expansions coming on-line and increasing wafer start capacities. Over the next 4 years, TECHCET is expecting domestic wafer start capacity to potentially jump to 46M in 2027, a 35% increase from the 34M wafer starts expected in 2023. As these wafer start numbers increase, material demands will escalate creating a gap in the supply needed to support the industry, as demonstrated in TECHCET’s Special Report on The Impact of Chip Expansions on US Chemical Supply Chains.

While the movement to more advanced devices will have a strong impact on US material requirements, recent announcements indicate that legacy (mature) node manufacturing will also drive domestic materials demand. Advanced node device manufacturing (14nm and smaller nodes) will drive an increase in high purity requirements, in addition to volume growth.

Over the 2023-2027 forecast period, domestic chemical production capacity is expected to increase slightly, but not enough to cover all chemical needs. Building a chemical plant to support semiconductor quality chemicals typically takes 2-3 years to come online, so there may be shortages experienced as soon as 2024 if new capacity is not running. Currently, imports cover a significant portion of the overall US wet chemical demand, especially for ultra-high purity (UHP) quality wet chemicals. If domestic supply is not ramped to support expansions, this reliance on imports will grow, creating vulnerabilities and ancillary issues for the domestic semiconductor supply chain.

H2SO4, IPA, HCl, HF, HNO3, and H3PO4 will all need boosts in domestic supply in order to meet demand from new fabs. Kanto/Chemtrade ha announced plans to expand on H2SO4, however, the timing of plant build and production is yet uncertain. Currently, UHP material is largely supported by qualified suppliers in Taiwan. Details on anticipated gaps in supply and volume requirements by purity grade can be found in TECHCET’s report on the “Impact of Chip Expansions on the US Wet Chemical Supply Chain” here: https://techcet.com/product/impact-of-chip-expansion-on-us-chemical-supply-chain-2/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact cmcinfo@techcet.com, +1-480-332-8336, or go to www.techcet.com.