Growth driven by developments in leading edge logic and memory

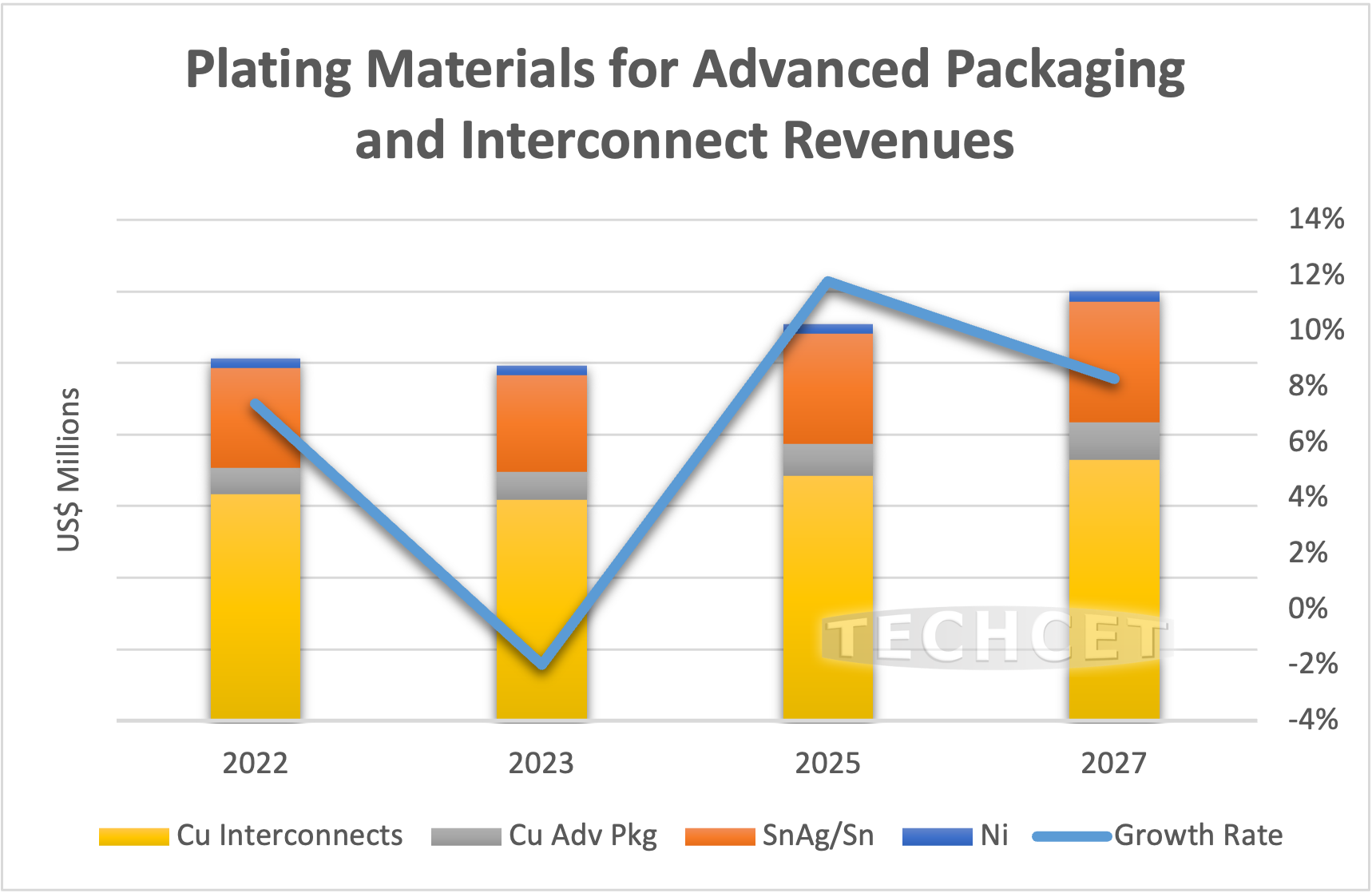

San Diego, CA, August 31, 2023: TECHCET — the electronic materials advisory firm providing business and technology information on semiconductor supply chains — reports that revenues for the Semiconductor Metal Plating Chemicals market will rise to USD $1,047M in 2024, a 5.6% increase from the forecasted USD $992M for 2023. The largest revenues for 2024 are forecasted for copper plating chemicals used for device-level interconnect and advanced packaging wiring, as explained in TECHCET’s newly released Metal Chemicals Critical Materials Report™. The 5-year CAGR’s for 2022-2027 are expected to remain on an upward track, with 3.5% growth for advanced packaging and 3% for copper device interconnects.

“Increased usage of advanced packaging, redistribution layers, and copper pillar structures are all factors contributing to the growth of the metal chemicals market segment,” states Dr. Karey Holland, Chief Strategist at TECHCET. Leading-edge logic and memory wafers are beginning to grow at a faster pace than legacy nodes, influencing a higher need for advanced packaging and increased metal layers. The fastest growing segment of advanced packaging is for fan-out wafer-level packaging (FOWLP), which will help boost growth in RDL plating applications.

TECHCET is not currently expecting new players in plating chemicals, however it would not be surprising if new players spring up in China to support their own domestic market. The introduction of Ru or Mo to displace the Ta & Co barrier layer at the GAA nodes is possible. Ru or Mo (ALD or CVD, not plating) will also possibly fill the interconnects & vias between M0 to M3 metal layers for Advanced Logic.

A potential risk factor for the metal chemicals market is increased lead times and price increases for electronic chemicals. Fabs and plating chemical suppliers are not reporting any difficulty obtaining metals for semiconductor plating in 2023, however shortages may occur in the future. Geopolitical tensions with China, for instance, may hinder availability of tin that is mined there. Similarly, nickel imported from Russia and Ukraine may face supply constraints.

For more details on the Semiconductor Metal Plating Chemicals market & supply chains, including profiles on companies such as BASF, Dupont, JX Nippon, Chang Chun Group, and more, go to: https://techcet.com/product/metal-chemicals-for-fe-advanced-packaging/.

To discuss more on the supply-chains for metal chemicals and other semiconductor materials, come talk to TECHCET at the CMC Seminar in Taichung, Taiwan on October 25th. For more information and to register, go to: https://cmcfabs.org/2023-cmc-seminar/.

ABOUT TECHCET: TECHCET CA LLC is an advisory services firm expert in market and supply-chain analysis of electronic materials for the semiconductor, display, solar/PV, and LED industries. TECHCET offers consulting, subscription service, and reports, including the Critical Materials Council (CMC) of semiconductor fabricators and Data Subscription Service (DSS). For additional information, please contact cmcinfo@techcet.com, +1-480-332-8336, or go to www.techcet.com.